Question: On December 12, 2011, Car entered into three forward exchange contracts, each to purchase 100,000 Canadian dollars in 90 days. Assume a 12 percent interest

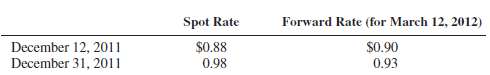

On December 12, 2011, Car entered into three forward exchange contracts, each to purchase 100,000 Canadian dollars in 90 days. Assume a 12 percent interest rate. The relevant exchange rates are as follows:

1. Car entered into the first forward contract to hedge a purchase of inventory in November 2011, payable in March 2012. At December 31, 2011, what amount of foreign currency transaction gain should Car include in income from this forward contract? Explain.2. Car entered into the second forward contract to hedge a commitment to purchase equipment being manufactured to Car's specifications. At December 31, 2011, what amount of net gain or loss on foreign currency transactions should Car include in income from this forward contract? Explain.3. Car entered into a third forward contract for speculation. At December 31, 2011, what amount of foreign currency transaction gain should Car include in income from this forward contract?Explain.

Spot Rate $0.88 0.98 Forward Rate (for March 12, 2012) December 12, 2011 December 31, 2011 $0.90

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

1 Assuming that this is a fair value hedgeAt 123111 3000 is the forward contract fair value 10000090 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

55-B-A-H-A (15).docx

120 KBs Word File