On January 1, 2011, Prado acquired 80% of the share capital of Lalli for $198,000. At this

Question:

On January 1, 2011, Prado acquired 80% of the share capital of Lalli for $198,000. At this date, the equity of

Lalli consisted of:

Share capital .........$150,000

Retained earnings....... 50,000

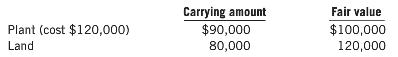

At January 1, 2011, all of Lalli€™s identiï¬able assets and liabilities were recorded at fair value except for the following assets:

The plant had a further ï¬ve-year life, with beneï¬ts expected to be received evenly over that period. The land was sold by Lalli in July 2013 for $150,000. Prado uses the partial goodwill method.

Financial information for these two companies at December 31, 2013, included:

-2.png)

Additional information:

1. During 2012, Lalli sold some inventory to Prado for $8,000. This inventory had originally cost Lalli $6,000. At December 31, 2012, 10% of these goods remained unsold by Prado.

2. The ending inventory of Prado included inventory sold to it by Lalli at a proï¬t of $3,000 before tax. This had cost Lalli $32,000.

3. On January 1, 2012, Lalli sold a plant to Prado for $50,000. This asset had a carrying value of $40,000. Prado depreciates it on a straight-line basis over a six-year period.

4. The tax rate is 30%.

5. Prado€™s share capital has always been $100,000.

6. On January 1, 2014, Prado sold 15% of its ownership in Lalli so that it now owns 65%. Prado received $20,000 for the shares.

Required

(a) Prepare the consolidated statement of comprehensive income and statement of changes in equity at December 31, 2013.

(b) Calculate the effect on consolidated equity in 2014 from the sale of shares.

(c) What would be the effect if Prado lost control at 65% ownership due to an agreement?

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Ending Inventory

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer: