Question: On January 2, 2012, Raconteur Corp. reported the following intangible assets : (1) copyright with a carrying value of $15,000, and (2) a trade name

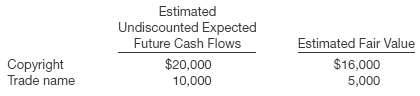

On January 2, 2012, Raconteur Corp. reported the following intangible assets: (1) copyright with a carrying value of $15,000, and (2) a trade name with a carrying value of $8,500. The trade name has a remaining life of 5 years and can be renewed at nominal cost indefinitely. The copyright has a remaining life of 10 years.At December 31, 2012, Raconteur assessed the intangible assets for possible impairment and developed the following information.

AccountingPrepare any journal entries required for Raconteur??s intangible assets at December 31, 2012.AnalysisMany stock analysts indicate a preference for less-volatile operating income measures. Such measures make it easier to predict future income and cash flows, using reported income measures. How does the accounting for impairments of intangible assets affect the volatility of operating income?PrinciplesMany accounting issues involve a trade-off between the primary characteristics of relevant and representationally faithful information. How does the accounting for intangible asset impairments reflect thistrade-off?

Estimated Undiscounted Expected Future Cash Flows Estimated Fair Value Copyright $20,000 $16,000 Trade name 10,000

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Accounting There is a full year of amortization on the copyright There is no amortization for the tr... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

51-B-A-I-A (539).docx

120 KBs Word File