Accounting, Analysis, and Principles On January 2, 2015, Raconteur Corp. reported the following intangible assets: (1) a

Question:

Accounting, Analysis, and Principles On January 2, 2015, Raconteur Corp. reported the following intangible assets: (1) a copyright with a carrying value of €15,000, and (2) a trade name with a carrying value of €8,500. The trade name has a remaining life of 5 years and can be renewed at nominal cost indefinitely. The copyright has a remaining life of 10 years.

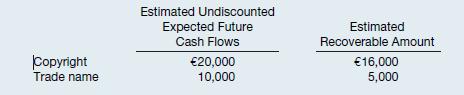

At December 31, 2015, Raconteur assessed the intangible assets for possible impairment and developed the following information.

Accounting Prepare any journal entries required for Raconteur’s intangible assets at December 31, 2015.

Analysis Many securities analysts indicate a preference for less-volatile operating income measures. Such measures make it easier to predict future income and cash flows, using reported income measures. How does the accounting for impairments of intangible assets affect the volatility of operating income?

Principles Many accounting issues involve a trade-off between the primary characteristics of relevance and faithful representation of information. How does the accounting for intangible asset impairments reflect this trade-off?

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield