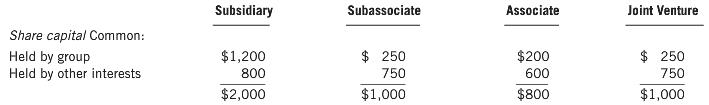

Question: Parent has one subsidiary, Subsidiary; one associate, Associate; and one joint venture, Joint Venture. Subsidiary has one associate, Sub-associate. Information about the companies for the

Parent has one subsidiary, Subsidiary; one associate, Associate; and one joint venture, Joint Venture. Subsidiary has one associate, Sub-associate.

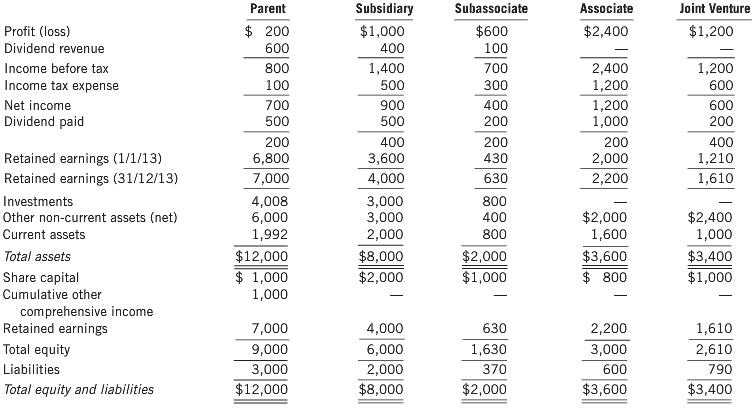

Information about the companies for the year ended December 31, 2013, is as follows:

Additional information:

1. Subsidiary: Parent acquired a 60% interest on December 31, 2005, for $3,000. Shareholders’ equity at December

31, 2005, was:

Share capital …………… $2,000

Retained earnings ………. 2,000

$4,000

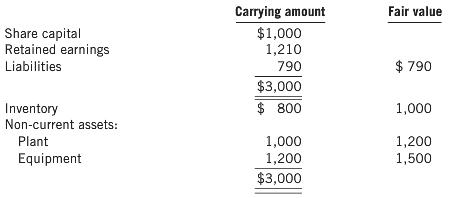

At the acquisition date, Subsidiary had not recorded any goodwill. All the identifiable assets and liabilities of Subsidiary were recorded at fair value except the following:

By December 31, 2005, all the inventory had been sold by Subsidiary. The non-current assets had a further expected life of 10 years, with benefits from use being received evenly over these years. The partial goodwill method is used.

2. Sub-associate: Subsidiary acquired, on January 1, 2012, 25% of the share capital for $400. Equity at December 31, 2011, was:

Share capital ………………. $1,000

Retained earnings …………. 230

At December 31, 2011, Sub-associate had not recorded any goodwill. All the identifiable assets and liabilities were recorded at fair value except for the following:

By December 31, 2013, half the inventory had been sold to external parties. The non-current assets have an unlimited life.

3. Parent: Included in current assets of Parent at December 31, 2013, is inventory that was purchased from Subsidiary for $900. Subsidiary sells its goods at cost plus 50% markup.

4. Parent: Included in current assets of Parent at December 31, 2012, was inventory that was purchased from Subsidiary for $600.

5. Subsidiary: Included in the non-current assets of Subsidiary at December 31, 2013, is an item of plant that was sold to Subsidiary by Sub-associate on January 1, 2013, for $1,200. At the date of sale, this asset had a carrying amount to Sub-associate of $1,000. It had an expected future useful life of five years, with benefits being received evenly over these years.

6. Associate: Parent acquired a 25% interest on December 31, 2010, for $400. Equity at December 31, 2010, was:

Share capital …………….. $800

Retained earnings ………… 600

At this date, Associate had not recorded any goodwill. All the identifiable assets and liabilities of Associate were recorded at fair value except for the following assets:

The inventory was all sold by December 31, 2011. The non-current assets had a further useful life of four years.

7. Joint Venture: Parent acquired a 25% interest on January 1, 2012, for $600. A comparison of carrying amounts and fair values at December 31, 2011, is shown below:

The plant had a further five-year life and the equipment had a further six-year life. By December 31, 2013, all the undervalued inventory had been sold.

8. Associate: On January 1, 2011, Associate sold a non-current asset to Parent for $500. At the time of sale, this asset had a carrying amount of $450. Parent depreciated this asset evenly over a five-year period.

9. Joint Venture: At December 31, 2013, Parent held inventory that was sold to it by Joint Venture at a profit before tax of $200 during the previous period.

10. Parent: On December 31, 2013, Parent held inventory that had been sold to it during the previous six months by Associate for $1,000. Associate made $400 profit before tax on the sale.

11. The tax rate is 30%.

Required

In preparation for the consolidated financial statements of Parent for the year ended December 31, 2013:

(a) Calculate the income from Associate, Sub-associate, and Joint Venture.

(b) Calculate the balances in the investments in Associate, Sub-associate, and Joint Venture as at December 31, 2013.

Subsidiary Subassociate Associate Joint Venture Share capital Common Held by group Held by othe interests $1,200 $250 750 $200 600 $ 250 750 800 $2,000 $1,000 $800 $1,000 Parent $ 200 600 800 Subsidiary $1,000 Subassociate Associate Joint Venture Profit (loss) Dividend revenue Income before tax Income tax expense Net income Dividend paid $600 100 700 300 400 200 200 430 630 $2,400 $1,200 400 500 900 500 400 3,600 4,000 3,000 3,000 2,000 $8,000 $2,000 2,400 1,200 1,200 1,000 1,200 600 600 200 400 1210 ,610 700 500 Retained earnings (1/1/13) Retained earnings (31/12/13) Investments Other non-current assets (net) Current assets Total assets Share capital Cumulative other 6,800 7,000 4,008 6,000 1,992 $12,000 $ 1,000 1,000 2,000 2,200 800 400 800 $2,000 1,600 $3,600 $800 $2,400 1,000 $3.400 $1,000 $2,000 $1,000 comprehensive income Retained earnings Total equity 7,000 9,000 3,000 $12,000 4,000 6,000 2,000 $8,000 630 1,630 370 $2,000 2,200 3,000 600 $3,600 2,610 790 $3,400 Total equity and liabifities Carrying amournt 500 1,200 Fair value $ 600 1,500 Inventory Non-current assets (net) Carrying amount $500 200 Fair value Inventory Non-current assets (net) $600 400 Carrying amount $100 500 Fair value nventory Non-current assets (net) $120 600 Carrying amount $1,000 1,210 Fair value Share capital Retained earnings Liabilities 790 1,000 1,200 790 $3,000 $800 Inventory Non-current assets: Plant Equipment 1,000 1,200 $3,000 1,500

Step by Step Solution

3.44 Rating (176 Votes )

There are 3 Steps involved in it

Subassociate OWN 25 equity method 1Jan12 Consideration transferred 400 Investment in Subassociate Net fair value of identifiable assets and Balance at ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

469-B-A-I (6014).docx

120 KBs Word File