Party Wagon, Inc., provides musical entertainment at weddings, dances, and various other functions. The company performs adjusting

Question:

Party Wagon, Inc., provides musical entertainment at weddings, dances, and various other functions. The company performs adjusting entries monthly, but prepares closing entries annually on December 31. The company recently hired Jack Armstrong as its new accountant. Jack's first assignment was to prepare an income statement, a statement of retained earnings, and a balance sheet using an adjusted trial balance given to him by his predecessor, dated December 31, current year.

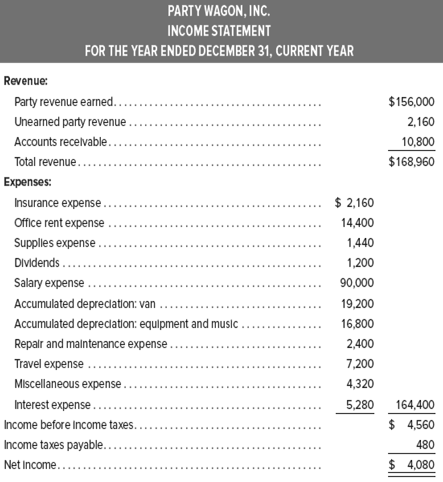

From the adjusted trial balance, Jack prepared the following set of financial statements.

PARTY WAGON, INC.

STATEMENT OF RETAINED EARNINGS

FOR THE YEAR ENDED DECEMBER 31, CURRENT YEAR

Retained earnings (per adjusted trial balance).................................$18,000

Add: Income ..........................................................................4,080

Less: Income taxes expense ........................................................ 2,400

Retained earnings Dec. 31, current year .......................................$19,680

-2.png)

Instructions

a. Prepare a corrected set of financial statements dated December 31, current year. (You may assume that all of the figures in the company's adjusted trial balance were reported correctly except for Interest Payable of $240, which was mistakenly omitted in the financial statements prepared by Jack.)

b. Prepare the necessary year-end closing entries.

c. Using the financial statements prepared in part a, briefly evaluate the company's profitability and liquidity. (No transactions affected the capital stock account during the year.)

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial and Managerial Accounting the basis for business decisions

ISBN: 978-1259692406

18th edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello