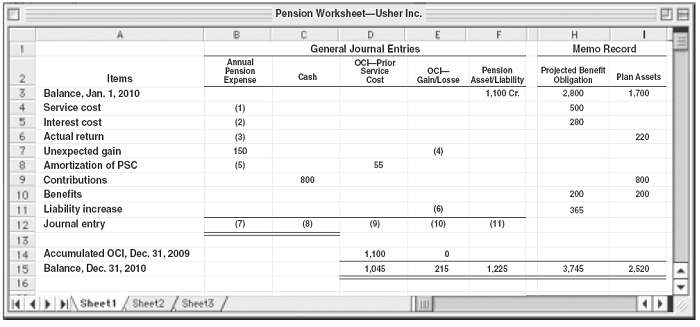

Question: (Pension Worksheet?Missing Amounts) The accounting staff of Usher Inc. has prepared the following pension worksheet. Unfortunately, several entries in the worksheet are not decipherable. The

(Pension Worksheet?Missing Amounts) The accounting staff of Usher Inc. has prepared the following pension worksheet. Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in completing the worksheet and completing the accounting tasks related to the pension plan for 2010.

(a) Determine the missing amounts in the 2010 pension worksheet, indicating whether the amounts are debits or credits.

(b) Prepare the journal entry to record 2010 pension expense for Usher Inc.

(c) The accounting staff has heard of a pension accounting procedure called ?corridor amortization.? Is Usher required to record any amounts for corridor amortization in (1) 2010 In (2) 2011? Explain.

Items Balance, Jan. 1, 2010 Service cost Interest cost 6 Actual return Unexpected gain 8 Amortization of PSC Contributions 4577244 3 9 10 Benefits 11 Liability increase 12 Journal entry 23456 13 14 Accumulated OCI, Dec. 31, 2009 15 Balance, Dec. 31, 2010 16 Sheet1 Sheet2/Sheet3 B Annual Pension Expense (1) (2) (3) 150 (5) Pension Worksheet-Usher Inc. C D General Journal Entries Cash 800 (8) OCI-Prior Service Cost 55 (9) 1,100 1,045 E OCH Pension Gain/Losse Asset/Liability 1,100 Cr. (4) (6) (10) 0 215 (11) 1.225 H Memo Record Projected Benefit Obligation 2,800 500 280 200 365 3,745 Plan Assets 1,700 220 800 200 2.520 34

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

a Below is the completed worksheet indicating debit and credit en... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-P-P-B (67).docx

120 KBs Word File