Pin, Inc., owns 80 percent of the capital stock of Son Company and 70 percent of the

Question:

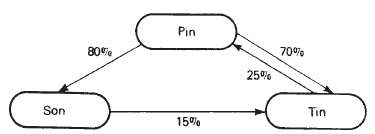

Pin, Inc., owns 80 percent of the capital stock of Son Company and 70 percent of the capital stock of Tin, Inc. Son owns 15 percent of the capital stock of Tin. Tin owns 25 percent of the capital stock of Pin. These ownership interrelationships are illustrated in the following diagram:

Income before adjusting for interests in intercompany income for each corporation follows:Pin, Inc. .... $190,000Son Company . $170,000Tin, Inc. .... $230,000The following notations relate to the questions below:A = Pin's consolidated income'its separate income plus its share of the consolidated incomes of Son and TinB = Son's consolidated income'its separate income plus its share of the consolidated income of TinC = Tin's consolidated income'its separate income plus its share of the consolidated income of Pin1. The equation, in a set of simultaneous equations, that computes A is:(a) A = 0.75(190,000 + 0.8B + 0.7C)(b) A = 190,000 + 0.8B + 0.7C(c) A = 0.75(190,000) + 0.8(170,000) + 0.7(230,000)(d) A = 0.75(190,000) + 0.8B + 0.7C2. The equation, in a set of simultaneous equations, that computes B is:(a) B = 170,000 + 0.15C + 0.75A(b) B = 170,000 + 0.15C(c) B = 0.2(170,000) + 0.15(230,000)(d) B = 0.2(170,000) + 0.15C3. Tin's noncontrolling interest share of consolidated income is:(a) 0.15(230,000)(b) 230,000 + 0.25A(c) 0.15(230,000) + 0.25A(d) 0.15C4. Son's noncontrolling interest share of consolidated income is:(a) $34,316(b) $25,500(c) $45,755(d)$30,675

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith