Question: Pla purchased a 40 percent interest in Sor, a foreign company, on January 1, 2011, for $342,000, when Sor's stockholders' equity consisted of 3,000,000 LCU

Pla purchased a 40 percent interest in Sor, a foreign company, on January 1, 2011, for $342,000, when Sor's stockholders' equity consisted of 3,000,000 LCU capital stock and 1,000,000 LCU retained earnings. Sor's functional currency is its local currency unit. The exchange rate at this time was $0.15 per LCU. Any excess allocated to patents is to be amortized over 10 years.

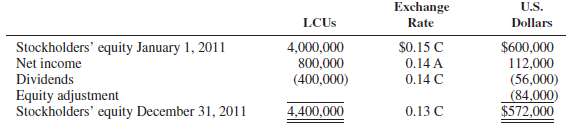

A summary of changes in the stockholders' equity of Sor during 2011 (including relevant exchange rates) is as follows:

REQUIRED:Determine the following:1. Excess patent from Pla's Investment in Sor on January 1, 20112. Excess patent amortization for 20113. Unamortized excess patent at December 31, 20114. Equity adjustment from patents for 20115. Income from Sor for 20116. Investment in Sor balance at December 31,2011

U.S. Exchange LCUS Rate Dollars Stockholders' equity January 1, 2011 Net income Dividends Equity adjustment Stockholders' equity December 31, 2011 4,000,000 $O.15 C $600,000 112,000 0.14 A 0.14 C (400,000) (84,000) 4.400,000 0.13 C $572,000

Step by Step Solution

3.44 Rating (170 Votes )

There are 3 Steps involved in it

1 Excess Patent at January 1 2011 Cost 342000 Book value of interest acquired 4000000 LCUs1540 24000... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

55-B-A-F-S (447).docx

120 KBs Word File