Question: Presented below and on page 348 are the purchases and cash payments journals for Richmond Co. for its first month of operations. In addition, the

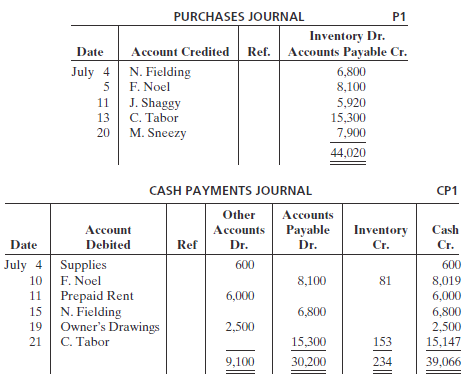

Presented below and on page 348 are the purchases and cash payments journals for Richmond Co. for its first month of operations.

In addition, the following transactions have not been journalized for July. The cost of all merchandise sold was 65% of the sales price.July 1 The founder, N. Richmond, invests $80,000 in cash.6 Sell merchandise on account to Abi Co. $6,200 terms 1/10, n/30.7 Make cash sales totaling $6,000.8 Sell merchandise on account to S. Beauty $3,600, terms 1/10, n/30.10 Sell merchandise on account to W. Pitts $4,900, terms 1/10, n/30.13 Receive payment in full from S. Beauty.16 Receive payment in full from W. Pitts.20 Receive payment in full from Abi Co.21 Sell merchandise on account to H. Prince $5,000, terms 1/10, n/30.29 Returned damaged goods to N. Fielding and received cash refund of $420.Instructions(a) Open the following accounts in the general ledger.101 Cash112 Accounts Receivable120 Inventory127 Supplies131 Prepaid Rent201 Accounts Payable301 Owner??s Capital306 Owner??s Drawings401 Sales Revenue414 Sales Discounts505 Cost of Goods Sold631 Supplies Expense729 Rent Expense(b) Journalize the transactions that have not been journalized in the sales journal, the cash receipts journal (see Illustration 7-9), and the general journal.(c) Post to the accounts receivable and accounts payable subsidiary ledgers. Follow the sequence of transactions as shown in the problem.(d) Post the individual entries and totals to the general ledger.(e) Prepare a trial balance at July 31, 2012.(f) Determine whether the subsidiary ledgers agree with the control accounts in the general ledger.(g) The following adjustments at the end of July are necessary.(1) A count of supplies indicates that $140 is still on hand.(2) Recognize rent expense for July, $500.Prepare the necessary entries in the general journal. Post the entries to the general ledger.(h) Prepare an adjusted trial balance at July 31,2012.

PURCHASES JOURNAL P1 Inventory Dr. Accounts Payable Cr. Account Credited Ref. Date July 4 5 N. Fielding F. Noel J. Shaggy C. Tabor M. Sneezy 6,800 8,100 5,920 11 13 15,300 7,900 20 44,020 CASH PAYMENTS JOURNAL CP1 Other Accounts Account Accounts Payable Dr. Inventory Cr. Cash Date Debited Ref Dr. Cr. Supplies F. Noel Prepaid Rent N. Fielding Owner's Drawings C. Tabor July 4 600 600 8,100 8,019 10 81 11 6,000 6.000 6,800 15 6,800 19 2,500 2,500 21 15,300 153 15,147 9,100 30,200 234 39,066

Step by Step Solution

3.34 Rating (172 Votes )

There are 3 Steps involved in it

a d g b c Accounts Receivable Subsidiary Ledger e f g h Cash Date ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

54-B-A-I-S (224).docx

120 KBs Word File