Question: Proration of overhead with two indirect cost pools. The Finer Furniture Company produces expensive desks for executives. The wood for the desks are cut into

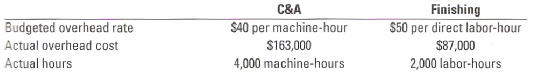

Proration of overhead with two indirect cost pools. The Finer Furniture Company produces expensive desks for executives. The wood for the desks are cut into standard sizes and the desks are assembled in the Construction and Assembly (C&A) department. The assembled desks are then sent to the Finishing Department to be stained. Overhead costs in the C&A department are allocated to production using machine—hours, and overhead costs in the Finishing Department are allocated using direct labor-hours. Finer Furniture uses a normal costing system and has the following data for 2008

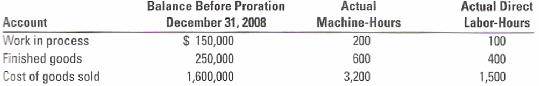

Ending balances, machine-hours and direct labor-hours data are as follows:

1. Calculate the over- or underallocated overhead for each of the C&A and Finishing departments in 2008.

2. Calculate the ending balances in work in process, finished goods and cost of goods sold if the under or overallocated overhead amounts in each department are:

a. Written off to cost of goods sold

b. Prorated based on the ending balance (before proration) in each of the three accounts

c. Prorated based on the overhead allocated in 2008 (before proration) in the ending balances in each of the three accounts.

3. Which method would you choose? Explain.

C&A Finishing $50 per direct labor-hour $87,000 2,000 labor-hours Budgeted overhead rate Actual overhead cost Actual hours S40 per machine-hour $163,000 4,000 machine-hours

Step by Step Solution

3.40 Rating (172 Votes )

There are 3 Steps involved in it

Proration of overhead with two indirect cost pools 1a C A department Overhead allocated 40 4000 Mach... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-C-P-A (160).docx

120 KBs Word File