Question: Rand Company manufactures modular homes. The company has two main products that it sells commercially: a 1,000- square- foot, one- bedroom model and a 1,500-

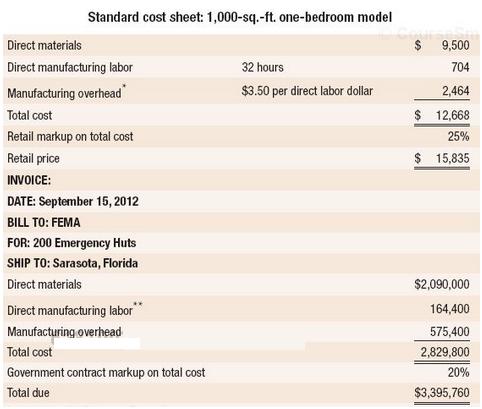

Rand Company manufactures modular homes. The company has two main products that it sells commercially: a 1,000- square- foot, one- bedroom model and a 1,500- square- foot, two- bedroom model. The company recently began providing emergency housing (huts) to FEMA, the Federal Emergency Management Agency. The emergency housing is similar to the 1,000- square- foot model. FEMA has requested Rand to create a bid for 150 emergency huts to be sent for wildfire victims in the west. Your manager has asked that you prepare this bid. In preparing the bid, you find a recent invoice to FEMA for 200 huts provided during the most recent hurricane season in the south. You also have a standard cost sheet for the 1,000- square- foot model sold commercially. Both are provided as follows:

* Overhead cost pool includes inspection labor ($ 15 per hour), setup labor ($ 12 per hour), and other indirect costs associated with production.

** Direct manufacturing labor includes 30 production hours per unit, 4 inspection hours per unit, and 6 setup hours per unit.

Required

1. Calculate the total bid if you base your calculations on the standard cost sheet assuming a cost plus 20% government contract.

2. Calculate the total bid if you base your calculations on the September 15, 2012, invoice assuming a cost plus 20% government contract.

3. What are the main discrepancies between the bids you calculated in requirements 1 and 2?

4. What bid should you present to your manager? What principles from the IMA Standards of Ethical Conduct for Practitioners of Management Accounting and Financial Management, as described in Chapter 1, should guide your decision? As the manager, what would you do?

Standard cost sheet: 1,000-sq.-ft. one-bedroom model Direct materials 9,500 Direct manufacturing labor 32 hours 704 Manufacturing overhead" $3.50 per direct labor dollar 2,464 Total cost $ 12,668 Retail markup on total cost 25% Retail price 15,835 INVOICE: DATE: September 15, 2012 BILL TO: FEMA FOR: 200 Emergency Huts SHIP TO: Sarasota, Florida Direct materials $2,090,000 Direct manufacturing labor" 164,400 Manufacturing overhead 575,400 Total cost 2,829,800 Government contract markup on total cost 20% Total due $3,395,760

Step by Step Solution

3.32 Rating (167 Votes )

There are 3 Steps involved in it

1 Direct manufacturing costs 1425000 Direct materials 9500150 huts Direct manufacturing labor 704150 huts 105600 Manufacturing overhead 35105600 36960... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

388-B-M-A-D-M (2174).docx

120 KBs Word File