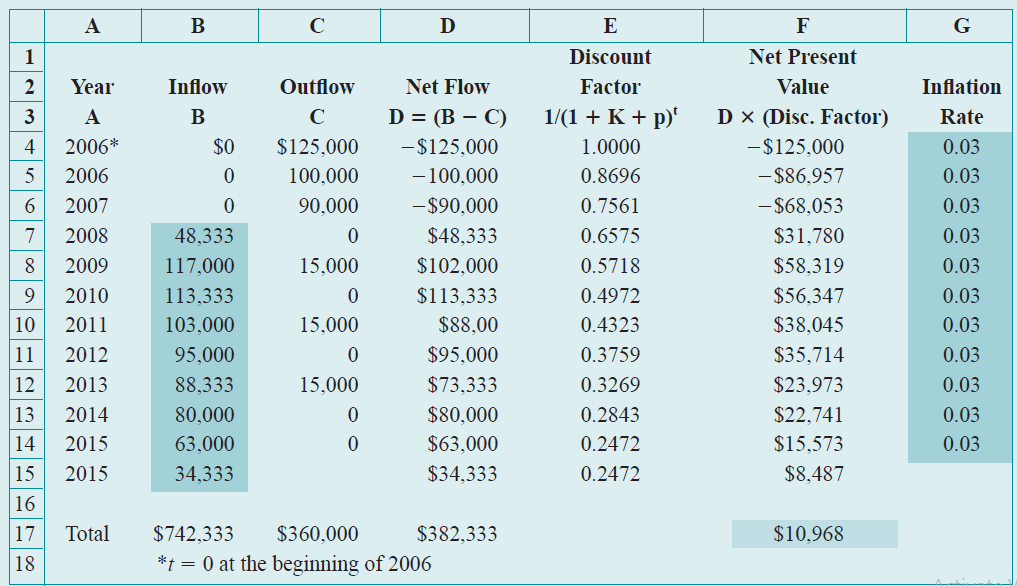

Question: Reconsider Table 2-3 to explain why the simulated outcome in Table 2-4 is only about half as much as the value originally obtained in Table

Reconsider Table 2-3 to explain why the simulated outcome in Table 2-4 is only about half as much as the value originally obtained in Table 2-2. Does the spread of the data in Table 2-3 appear realistic?

D F 1 Discount Net Present Year Factor Inflow Outflow Net Flow Value Inflation D = (B C) x (Disc. Factor) 1/(1 + K + p)' D Rate 2006* $0 $125,000 -$125,000 -$125,000 1.0000 0.03 - 100,000 - $90,000 2006 100,000 -$86.957 0.8696 0.03 2007 90,000 - $68,053 0.7561 0.03 48,333 $48,333 $31,780 2008 0.6575 0.03 $102,000 0.5718 $58,319 2009 117,000 15,000 0.03 2010 $113,333 $56,347 113,333 0.4972 0.03 10 15,000 $88,00 $38,045 2011 103,000 0.4323 0.03 $95,000 $35,714 11 2012 95,000 0.3759 0.03 $73,333 0.3269 $23,973 12 2013 88,333 15,000 0.03 |13 $80,000 $22,741 2014 80,000 0.2843 0.03 $63,000 $15,573 2015 63,000 0.2472 0.03 34,333 $34,333 $8,487 2015 0.2472 |17 Total $742,333 $360,000 $382,333 $10,968 *t = 0 at the beginning of 2006 18

Step by Step Solution

3.53 Rating (167 Votes )

There are 3 Steps involved in it

The original estimate was derived from the most likely values The distribution for each year ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

84-B-M-L-P-M (66).docx

120 KBs Word File