Refer to Short Exercise S26-4. Assume the expansion has no residual value. What is the projects NPV

Question:

Refer to Short Exercise S26-4. Assume the expansion has no residual value. What is the project’s NPV (round to nearest dollar)? Is the investment attractive? Why or why not?

Data from Short Exercise S26-4

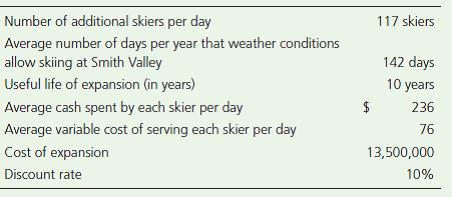

Consider how Smith Valley Snow Park Lodge could use capital budgeting to decide whether the $13,500,000 Snow Park Lodge expansion would be a good investment. Assume Smith Valley’s managers developed the following estimates concerning the expansion:

Assume that Smith Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $1,000,000 at the end of its 10-year life.

Number of additional skiers per day 117 skiers Average number of days per year that weather conditions allow skiing at Smith Valley 142 days Useful life of expansion (in years) 10 years Average cash spent by each skier per day $ 236 Average variable cost of serving each skier per day 76 Cost of expansion 13,500,000 Discount rate 10%

Step by Step Answer:

Time Net Cash Inflow Annuity PV Factor i 10n 10 Present Value 1 10 years ...View the full answer

Horngrens Financial and Managerial Accounting

ISBN: 978-0133255584

4th Edition

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Corporate Finance questions

-

Consider how Smith Valley Snow Park Lodge could use capital budgeting to decide whether the $13,500,000 Snow Park Lodge expansion would be a good investment. Assume Smith Valleys managers developed...

-

Consider how Smith Valley Snow Park Lodge could use capital budgeting to decide whether the $ 13,500,000 Snow Park Lodge expansion would be a good investment. Assume Smith Valleys managers developed...

-

Consider how Hunter Valley Snow Park Lodge could use capital budgeting to decide whether the $11,000,000 Snow Park Lodge expansion would be a good investment. Assume Hunter Valley's managers...

-

F udy A big part of communication is sharing personal information with another person. Some information we believe we have the right to be our own and should remain private. However, the degree to...

-

A molecular compound is composed of 60.4% Xe, 22.1% O, and 17.5% F, by mass. If the molecular weight is 217.3 amu, what is the molecular formula? What is the Lewis formula? Predict the molecular...

-

What does the coefficient of variation measure? Why is a lower value better for the investor?

-

Show that the residuals from a linear regression model can be expressed as $\mathbf{e}=(\mathbf{I}-\mathbf{H}) \boldsymbol{\varepsilon}$.

-

Alpha Products, Inc., is having a problem trying to control inventory. There is insufi cient time to devote to all its items equally. Here is a sample of some items stocked, along with the annual...

-

Gross profit 464,000 Other income Provision for foreign exchange gain 84,000 Gain on sale of motor vehicle 28,000 Release of liability 32,000 Refund of excise duty 16,000 Investment income (gross)...

-

1. The Backwoods American Company produces approximately 43,773 parkas annually. The quality management program the company implemented was able to improve the average percentage of good parkas...

-

Refer to the Smith Valley Snow Park Lodge expansion project in Short Exercise S26- 4. What is the projects NPV (round to nearest dollar)? Is the investment attractive? Why or why not? Data from Short...

-

Using IRR to make capital investment decisions Refer to Short Exercise S26-4. Continue to assume that the expansion has no residual value. What is the projects IRR? Is the investment attractive? Why...

-

Let today be time t. Suppose you want to price a plain vanilla option with expiry date T on a discount bond, maturing at S, within the Black-76-model, with t Compute the quantity d+/?, required in...

-

What is a key difference between content management systems and wikis? a. They are different terms for the same tool. b. Content management systems are less formal and less structured than wikis. c....

-

An advantage of using the direct approach with negative messages is that it a. saves readers time by helping them reach the main idea more quickly. b. eases readers into the message. c. is...

-

What are the disadvantages in a situation where an organization chooses to share negative information at the very last moment possible?

-

Determine whether the following sentences focus on selling points or benefits; rewrite as necessary to focus all the sentences on benefits. a. This model has heated front seats in black Nappa...

-

Convincing people to give their music a try is one of the toughest challenges new bands and performers face. Your task: Imagine youve taken on the job of promoting an amazing new band or performer...

-

Two cylindrical space stations, the second four times the diameter of the first, rotate so as to provide the same amount of artificial gravity. If the first station makes one rotation in the time T,...

-

Ashlee, Hiroki, Kate, and Albee LLC each own a 25 percent interest in Tally Industries LLC, which generates annual gross receipts of over $10 million. Ashlee, Hiroki, and Kate manage the business,...

-

Compute the utilization for these task sets: a. P1: period = 1 s, execution time = 10 ms; P2: period = 100 ms, execution time 10 ms b. P1: period 100 ms, execution time = 25 ms; P2: period = 80 ms,...

-

Assume that Jump Coffee Shop completed the following periodic inventory transactions for a line of merchandise inventory: Requirements 1. Compute ending merchandise inventory, cost of goods sold, and...

-

Assume that Jump Coffee Shop completed the following periodic inventory transactions for a line of merchandise inventory: Requirements 1. Compute ending merchandise inventory, cost of goods sold, and...

-

Consider the data of the following companies which use the periodic inventory system: Requirements 1. Supply the missing amounts in the preceding table. 2. Prepare the income statement for the year...

-

4) Suppose that you are given the following information for BlackBerry's common stock: Year 2017 2018 2019 2020 2021 Price ($) 26.0 28.6 26.3 30.5 31.1 What is the arithmetic mean of the rate of...

-

1. Introduce and explain the Fashion Minimalism , how it came to be, e.g.: origins/inception. 2. Identify what the Fashion Minimalism and how it encompasses sustainability in the fashion industry. 3....

-

What are the x- intercepts of the function f(x) = (x+7)(x 6)? -

Study smarter with the SolutionInn App