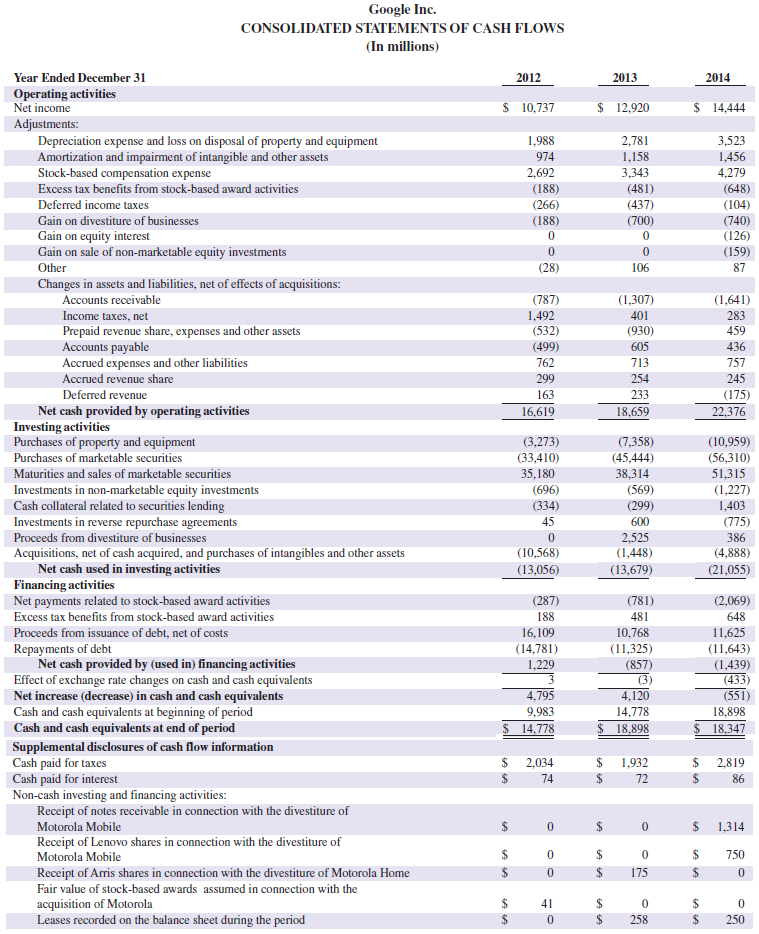

Question: Refer to the statement of cash flows for Google in Appendix A for the fiscal year ended December 31, 2014, to answer the following. 1.

Refer to the statement of cash flows for Google in Appendix A for the fiscal year ended December 31, 2014, to answer the following.

1. What amount of cash is used to purchase property and equipment?

2. How much depreciation and amortization of property and equipment are recorded?

3. What total amount of net cash is used in investing activities?

Statement of cash flows for Google in Appendix A Below:

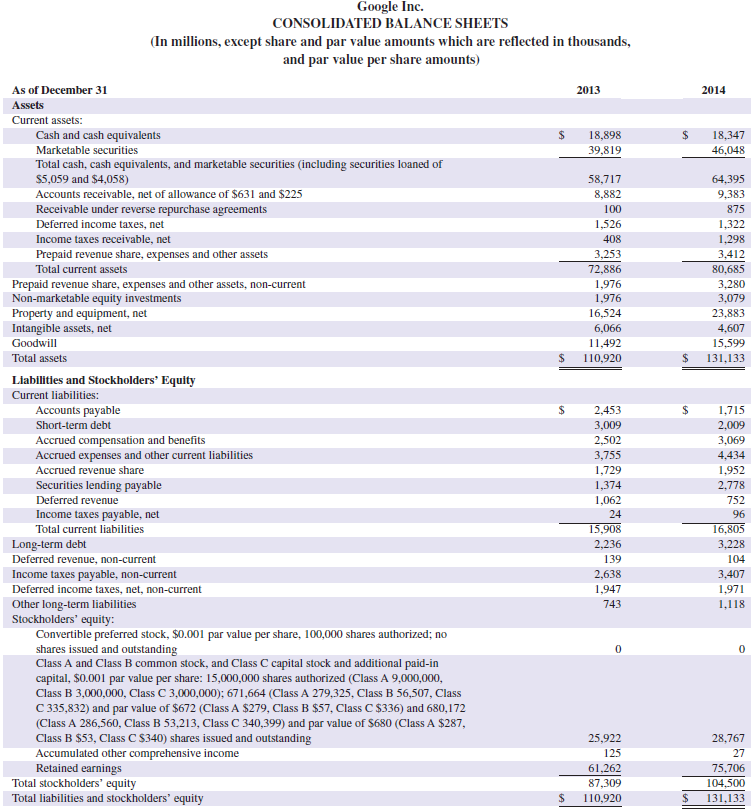

Google Inc. CONSOLIDATED BALANCE SHEETS (In millions, except share and par value amounts which are reflected in thousands, and par value per share amounts) As of December 31 2014 2013 Assets Current assets: Cash and cash equivalents Marketable securities 2$ %24 18,898 18,347 39,819 46,048 Total cash, cash equivalents, and marketable securities (including securities loaned of $5,059 and $4,058) Accounts receivable, net of allowance of $631 and $225 Receivable under reverse repurchase agreements 58,717 64,395 8,882 9,383 100 875 Deferred income taxes, net 1,526 1,322 1,298 Income taxes receivable, net 408 3,253 Prepaid revenue share, expenses and other assets 3,412 Total current assets 72,886 80,685 Prepaid revenue share, expenses and other assets, non-current Non-marketable equity investments Property and equipment, net Intangible assets, net 1,976 3,280 1,976 3,079 16,524 23,883 6,066 4,607 11,492 Goodwill 15,599 2$ Total assets 110,920 131,133 Liabilities and Stockholders' Equlty Current liabilities: 24 Accounts payable 2,453 1,715 Short-term debt 3,009 2,009 Accrued compensation and benefits Accrued expenses and other current liabilities 2,502 3,069 4,434 3,755 Accrued revenue share 1,729 1,952 Securities lending payable 1,374 2,778 Deferred revenue 1,062 752 Income taxes payable, net 24 96 15,908 16,805 Total current liabilities Long-term debt 2,236 3,228 Deferred revenue, non-current 139 104 Income taxes payable, non-current Deferred income taxes, net, non-current Other long-term liabilities Stockholders' equity: Convertible preferred stock, $0.001 par value per share, 100,000 shares authorized; no shares issued and outstanding Class A and Class B common stock, and Class C capital stock and additional paid-in 2,638 3,407 1,971 1,947 743 1,118 capital, $0.001 par value per share: 15,000,000 shares authorized (Class A 9,000,000, Class B 3,000,000, Class C 3,000,000); 671,664 (Class A 279,325, Class B 56,507, Class C 335,832) and par value of $672 (Class A $279, Class B $57, Class C $336) and 680,172 (Class A 286,560, Class B 53,213, Class C 340,399) and par value of $680 (Class A $287, Class B $53, Class c $340) shares issued and outstanding Accumulated other comprehensive income Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 25,922 28,767 125 27 61,262 75,706 87,309 104,500 2$ 24 110,920 131,133 %24

Step by Step Solution

3.37 Rating (172 Votes )

There are 3 Steps involved in it

1 10959 million cash for prope... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1180-B-C-A-B(2474).docx

120 KBs Word File