Question: Refer to the information in Problem 17-1B. Prepare a statement of cash flows for 2014 using the direct method to report cash inflows and outflows

Refer to the information in Problem 17-1B. Prepare a statement of cash flows for 2014 using the direct method to report cash inflows and outflows from operating activities.

Other information:

a. All sales were credit sales.

b. All credits to accounts receivable in the period were receipts from customers.

c. Purchases of merchandise were on credit.

d. All debits to accounts payable were from payments for merchandise.

e. The other operating expenses were cash expenses.

f. The decrease in income taxes payable was for payment oftaxes.

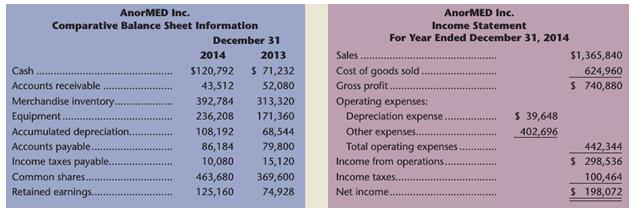

AnorMED Inc. AnorMED Inc. Comparative Balance Sheet Information Income Statement December 31 For Year Ended December 31, 2014 2014 2013 Sales. $1,365,840 $120,792 $ 71,232 Cost of goods sold Gross profit.. Cash 624,960 Accounts receivable 43,512 52,080 $ 740,880 Merchandise inventory. Equipment. Accumulated depreciation. Accounts payable. Income taxes payable. Operating expenses: Depreciation expense. 392,784 313,320 171,360 S 39,648 236,208 108,192 86,184 10,080 Other expenses.. Total operating expenses.. Income from operations.. 68,544 402,696 79,800 15,120 442,344 $ 298,536 Common shares. 463,680 369,600 Income taxes... 100,464 Retained earnings.. 125,160 74,928 Net income.. S 198,072

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

ANORMED INC Statement of Cash Flows For Year Ended December 31 2014 Cash flows from operating activ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

384-B-A-B-S-C-F (1190).docx

120 KBs Word File