Question: Burrow Mining Inc.s comparative balance sheet information at December 31, 2014 and 2013, and its income statement for the year ended December 31, 2014, are

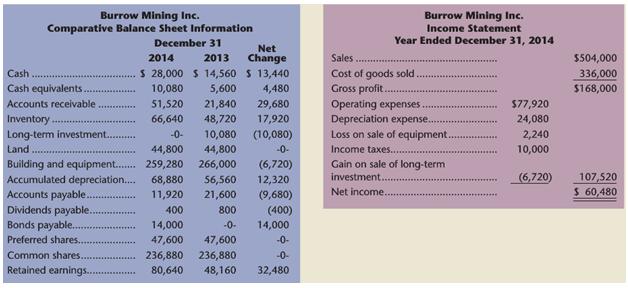

Burrow Mining Inc.’s comparative balance sheet information at December 31, 2014 and 2013, and its income statement for the year ended December 31, 2014, are as follows:

During 2014, the following transactions occurred:

1. Issued $14,000 of bonds payable at face value.

2. Sold the long-term investment on January 1, 2014, for $16,800.

3. Sold equipment for $3,920 cash that had originally cost $17,920 and had $11,760 of accumulated depreciation.

4. Purchased equipment for $11,200 cash.

Required

a. How much was paid in dividends during 2014?

b. Prepare a statement of cash flows for Burrow Mining Inc. for the year ended December 31, 2014, using the indirect method.

Analysis Component: Accounts Receivable increased from $21,840 to $51,520 in 2014. What transactions cause this account to change? Accounts Payable decreased during 2014. What causes this account tochange?

Burrow Mining Inc. Comparative Balance Sheet Information Burrow Mining Inc. Income Statement December 31 Year Ended December 31, 2014 Net 2014 2013 Change Sales 5504,000 S 28,000 S 14,560 S 13,440 5,600 21,840 Cash Cost of goods sold. Gross profit. Operating expenses Depreciation expense. Loss on sale of equipment. 336,000 $168,000 Cash equivalents. 10,080 4,480 Accounts receivable 51,520 29,680 $77,920 17,920 24,080 Inventory Long-term investment.. Land 66,640 48,720 -0- 10,080 44,800 266,000 (10,080) 2,240 10,000 44,800 -0- Income taxes. Gain on sale of long-term Building and equipment. 259,280 Accumulated depreciation.. Accounts payable. Dividends payable.. Bonds payable. Preferred shares.. Common shares. Retained earnings..... (6,720) 12,320 (9,680) investment.. (6,720) 107,520 68,880 11,920 56,560 21,600 S 60,480 Net income. 400 800 (400) 14,000 14,000 -0- 47,600 47,600 -0- 236,880 80,640 236,880 48,160 -0- 32,480

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Part 1 Cash dividends DECLARED 28000 Net income of 60480 less 32480 change in retained earnings But ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

384-B-A-B-S-C-F (1191).docx

120 KBs Word File