Question: Returns and Standard Deviations consider the following information. a. Your portfolio is invested 30 percent each in A and C, and 40 percent in-B. What

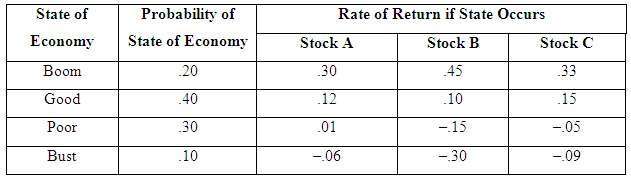

Returns and Standard Deviations consider the following information.

a. Your portfolio is invested 30 percent each in A and C, and 40 percent in-B. What is the expected return of the portfolio?

b. What is the variance of this portfolio, the standard deviation?

Probability of State of Rate of Return if State Occurs State of Economy Economy Stock B 45 Stock A Stock C 20 33 Boom 30 Good 40 .10 .15 12 30 -.05 Poor 01 -15 Bust - 30 -09 -06 .10

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

a This portfolio does not have an equal weight in each asset We first need to find the return of the ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

29-B-C-F-R-A-R (51).docx

120 KBs Word File