Russell Company was incorporated on January 1, 2012, with the issuance of capital stock in return for

Question:

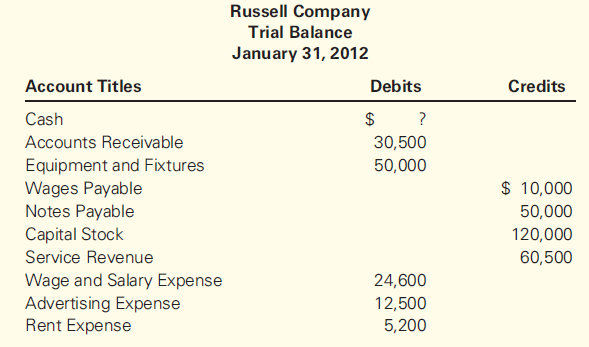

Russell Company was incorporated on January 1, 2012, with the issuance of capital stock in return for $120,000 of cash contributed by the owners. The only other transaction entered into prior to beginning operations was the issuance of a $50,000 note payable in exchange for equipment and fixtures. The following trial balance was prepared at the end of the first month by the book keeper for Russell Company:

Required

1. Determine the balance in the Cash account.

2. Identify all of the transactions that affected the Cash account during the month. Use a

T account to prove what the balance in Cash will be after all transactions are recorded.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Using Financial Accounting Information The Alternative to Debits and Credits

ISBN: 978-1111534912

8th edition

Authors: Gary A. Porter, Curtis L. Norton

Question Posted: