Salari Industries, a small, family- run manufacturer, has adopted an ABC system. The following manufacturing activities, indirect

Question:

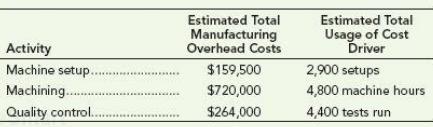

Salari Industries, a small, family- run manufacturer, has adopted an ABC system. The following manufacturing activities, indirect manufacturing costs, and usage of cost drivers have been estimated for the year:

During May, John and Allison Salari machined and assembled Job 557. John worked a total of 12 hours on the job, while Allison worked 4 hours on the job. John is paid a $ 25 per hour wage rate, while Allison is paid $ 28 per hour because of her additional experience level. Direct materials requisitioned for Job 557 totaled $ 1,250. The following additional information was collected on Job 557: the job required 2 machine setups, 4 machine hours, and 3 quality control tests.

1. Compute the activity cost allocation rates for the year.

2. Complete the following job cost record for Job 557:

Job Cost Record Job 557 Manufacturing Costs Direct

Materials............................................................................. ?

Direct labor............................................................................ ?

Manufacturing overhead..................................................... ?

Total job cost....................................................................... $ ?

Step by Step Answer: