Question: Sante Fe Corporation's sales office and manufacturing plant are located in State A. Sante Fe also maintains a manufacturing plant and sales office in State

Sante Fe Corporation's sales office and manufacturing plant are located in State A. Sante Fe also maintains a manufacturing plant and sales office in State B. For purposes of apportionment, State A defines payroll as all compensation paid to employees, including contributions to § 401(k) deferred compensation plans.

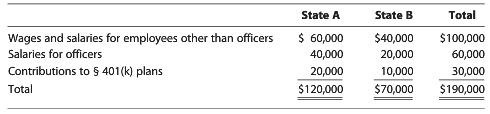

Under the statutes of State B, neither compensation paid to officers nor contributions to § 401(k) plans are included in the payroll factor. Sante Fe incurred the following personnel costs.

What is the payroll factor for:

a. State A?

State A State B Total Wages and salaries for employees other than officers 60,000 $40,000 $100,000 Salaries for officers Contributions to S 401(k) plans Tota 40,000 20,000 $120,000 20,000 10,000 70,000 $190,000 60,000 30,000

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

The payroll factor is determined by comparing the compensation paid for services r... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

527-L-B-L-C (331).docx

120 KBs Word File