Selected account balances for the year ended December 31 are provided below for Superior Company: Selling and

Question:

Selected account balances for the year ended December 31 are provided below for Superior Company:

Selling and administrative salaries?????????? $110,000

Insurance, factory???????????????..??? ? ? ?$8,000

Utilities, factory???????????????????. ? ? ?$45,000

Purchases of raw materials????????????. ? ? $290,000

Indirect labor???????????????????. ? ? ? ? ?$60,000

Direct labor????????????????????? ? ? ? ? ? ? ? ? ? ??

Advertising expense????????????????. ? ? ?$80,000

Cleaning supplies, factory????????????. ? ? ? ? ? $7,000

Sales commissions????????????????. ? ? ? ? $50,000

Rent, factory building???????????????. ? ? $120.000

Maintenance, factory??????????????? ? ? ? ? $30,000

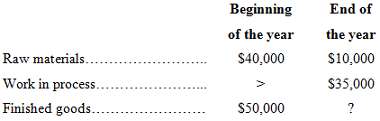

Inventory balances at the beginning and end of the year were as follows:

The total manufacturing costs for the year were $660,000; the goods available for sale totaled $740,000 and the cost of goods sold totaled $660,000.Required:1. Prepare a schedule of cost of goods manufactured and the cost of goods sold section of the companys income statement for the year.2. Assume that the dollar amounts given above are for the equivalent of 40,000units produced during the year. Compute the average cost per unit for direct materials used and the average cost per unit for rent on the factory building.3. Assume that in the following year the company expects to produce 50,000 units. What average cost per unit and total cost would you expect to be incurred for direct material for rent on the factory building? (Assume that direct materials are a variable cost and that rent is a fixed cost).4. As the manager in charge of production costs, explain to the president the reason for any difference in average cost per unit between (2) and (3) above.

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer