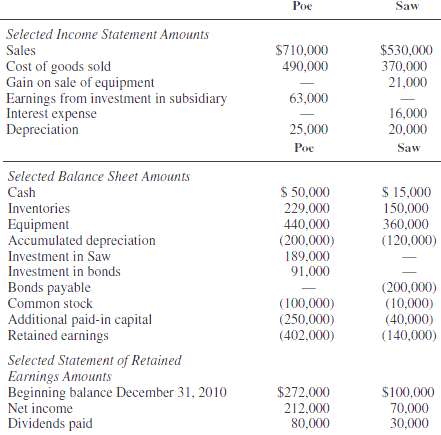

Question: Selected amounts from the separate unconsolidated financial statements of Poe Corporation and its 90 percent-owned subsidiary, Saw Company, at December 31, 2011, are as follows.

Selected amounts from the separate unconsolidated financial statements of Poe Corporation and its 90 percent-owned subsidiary, Saw Company, at December 31, 2011, are as follows.

ADDITIONAL INFORMATION1. On January 2, 2011, Poe purchased 90 percent of Saw's 100,000 outstanding common stock for cash of $153,000. On that date, Saw's stockholders' equity equaled $150,000 and the fair values of Saw's assets and liabilities equaled their carrying amounts. Poe accounted for the combination as an acquisition. The difference between fair value and book value was due to goodwill.2. On September 4, 2011, Saw paid cash dividends of $30,000.3. On December 31, 2011, Poe recorded its equity in Saw's earnings.4. On January 3, 2011, Saw sold equipment with an original cost of $30,000 and a carrying value of $15,000 to Poe for $36,000. The equipment had a remaining life of three years and was depreciated using the straight-line method by both companies.5. During 2011, Saw sold merchandise to Poe for $60,000, which included a profit of $20,000. At December 31, 2011, half of this merchandise remained in Poe's inventory.6. On December 31, 2011, Poe paid $91,000 to purchase half of the outstanding bonds issued by Saw. The bonds mature on December 31, 2017, and were originally issued at par. These bonds pay interest annually on December 31 of each year, and the interest was paid to the prior investor immediately before Poe's purchase of the bonds.REQUIRED: Determine the amounts at which the following items will appear in the consolidated financial statements of Poe Corporation and Subsidiary for the year ended December 31, 2011.1. Cash2. Equipment less accumulated depreciation3. Investment in Saw4. Bonds payable (net of unamortized discount)5. Common stock6. Beginning retained earnings7. Dividends paid8. Gain on retirement of bonds9. Cost of goods sold10. Interest expense11. Depreciationexpense

Poe Saw Selected Income Statement Amounts $530,000 370,000 21,000 Sales $710,000 490,000 Cost of goods sold Gain on sale of equipment Earnings from investment in subsidiary Interest expense Depreciation 63,000 16,000 20,000 25.000 Poe Saw Selected Balance Sheet Amounts $ 15,000 $ 50,000 Cash Inventories 229.000 150,000 Equipment Accumulated depreciation Investment in Saw Investment in bonds 440,000 360,000 (200,000) (120.000) 189,000 91,000 Bonds payable Common stock (200,000) (10,000) (40,000) (140,000) (100,000) Additional paid-in capital Retained earnings (250,000) (402.000) Selected Statement of Retained Earnings Amounts Beginning balance December 31, 2010 Net income $272.000 212,000 80,000 $100,000 70,000 30,000 Dividends paid

Step by Step Solution

3.52 Rating (183 Votes )

There are 3 Steps involved in it

1 Consolidated cash 50000 15000 65000 2 Equipment X net 800000 equipment 320000 accumulated deprecia... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

55-B-A-T-D (303).docx

120 KBs Word File