The separate income statements of Pea Corporation and its 90 percent-owned subsidiary, Sea Corporation, for 2011 are

Question:

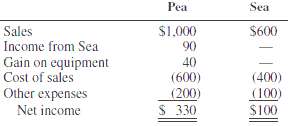

The separate income statements of Pea Corporation and its 90 percent-owned subsidiary, Sea Corporation, for 2011 are summarized as follows (in thousands):

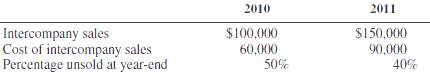

Investigation reveals that the effects of certain intercompany transactions are not included in Pea's income from Sea. Information about those intercompany transactions follows:1. Inventories'Sales of inventory items from Pea to Sea are summarized as follows:

2. Plant assets'Pea sold equipment with a book value of $60,000 to Sea for $100,000 on January 1, 2011. Sea depreciates the equipment on a straight-line basis (no scrap) over a four-year period.REQUIRED1. Determine the correct amount of Pea's income from Sea for 2011.2. Prepare a consolidated income statement for Pea Corporation and Subsidiary for2011.

Consolidated Income StatementWhen talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith