Question: Several years ago, your brother opened Niagara Appliance Repairs. He made a small initial investment and added money from his personal bank account as needed.

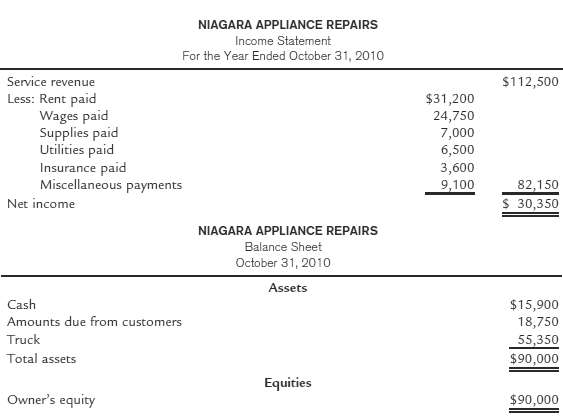

Several years ago, your brother opened Niagara Appliance Repairs. He made a small initial investment and added money from his personal bank account as needed. He withdrew money for living expenses at irregular intervals. As the business grew, he hired an assistant. He is now considering adding more employees, purchasing additional service trucks, and purchasing the building he now rents. To secure funds for the expansion, your brother submitted a loan application to the bank and included the most recent financial statements (shown below) prepared from accounts maintained by a part-time bookkeeper.

After reviewing the financial statements, the loan officer at the bank asked your brother if he used the accrual basis of accounting for revenues and expenses. Your brother responded that he did and that is why he included an account for "Amounts Due from Customers."? The loan officer then asked whether or not the accounts were adjusted prior to the preparation of the statements. Your brother answered that they had not been adjusted.a. Why do you think the loan officer suspected that the accounts had not been adjusted prior to the preparation of the statements?b. Indicate possible accounts that might need to be adjusted before an accurate set of financial statements could be prepared.

NIAGARA APPLIANCE REPAIRS Income Statement For the Year Ended October 31, 2010 Service revenue Less: Rent paid Wages paid Supplies paid Utilities paid Insurance paid Miscellaneous payments $112,500 $31,200 24,750 7,000 6,500 3,600 9,100 82,150 $ 30,350 Net income NIAGARA APPLIANCE REPAIRS Balance Sheet October 31, 2010 Assets Cash $15,900 Amounts due from customers 18,750 Truck 55,350 $90,000 Total assets Equities Owner's equity $90,000

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

a There are several indications that adjustments were not recor... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

59-B-A-I-A (626).docx

120 KBs Word File