Question: Spring Manufacturing Company has had a continuous improvement (kaizen) program for the last two years. According to the kaizen program, the firm is expected to

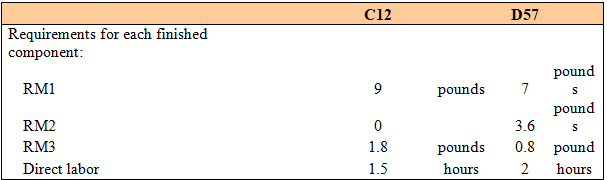

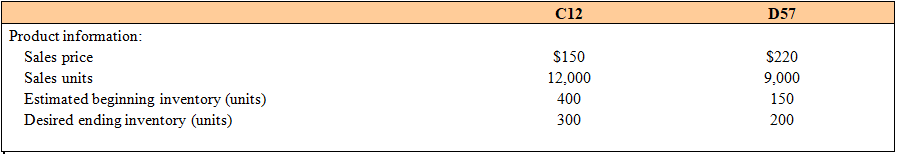

Spring Manufacturing Company has had a continuous improvement (kaizen) program for the last two years. According to the kaizen program, the firm is expected to manufacture C12 and D57 with the following specifications:

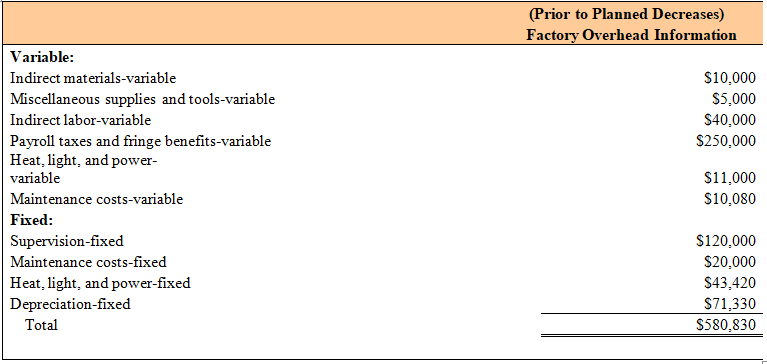

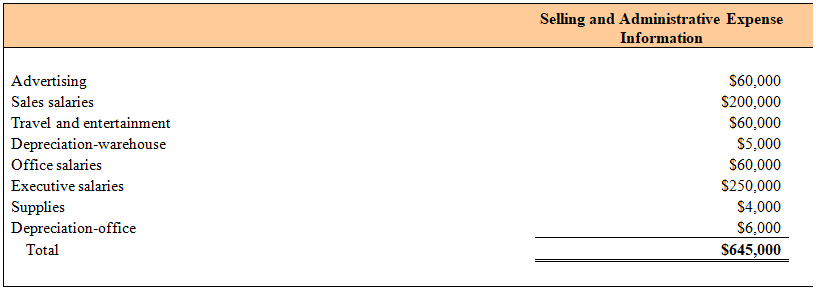

| The company also anticipates the following changes: | |

| Decrease in variable factory overhead | 10.00% |

| Decrase in total fixed overhead costs | 5.00% |

| Hourly wage rate, direct labor | $30.00 |

| Direct Materials Information | ||||||

| RM1 | RM2 | RM3 | ||||

| Cost per pound | $2.00 | $2.50 | $0.50 | |||

| Estimated beginning inventory in pounds | 3,000 | 1,500 | 1,000 | |||

| Desired ending inventory in pounds | 4,000 | 1,000 | 1,500 | |||

Income tax = 40%

Required

1. What is the budgeted after-tax operating income if the firm can attain the expected operation level as prescribed by its kaizen program?

2. What are the benefits of Spring Manufacturing Company adopting a continuous improvement program? What are thelimitations?

D57 C12 Requirements for each finished component: pound RM1 pounds pound 3.6 0.8 pound 2 RM2 RM3 pounds hours 1.8 Direct labor hours 1.5

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Spring Manufacturing Company Sales Budget 2010 C12 D57 Total Sales in units 12000 9000 21000 x Price Per Unit 150 220 Total Revenue 1800000 1980000 3780000 Spring Manufacturing Company Production Budg... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

249-B-M-L-P (454).xlsx

300 KBs Excel File