Stork Corporation paid $15,300 for a 90% interest in Swamp Corporation on January 1, 2004, when Swamp

Question:

Stork Corporation paid $15,300 for a 90% interest in Swamp Corporation on January 1, 2004, when Swamp stockholders' equity consisted of $10,000 Capital Stock and $3,000 of Retained Earnings. The non-controlling interest was valued at $1,700 on January 1, 2004. The excess cost over book value was attributable to goodwill.

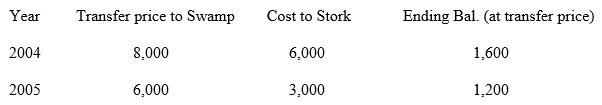

The affiliates regularly engage in transactions with each other. During 2004 and 2005, Stork had the following sales to Swamp.

At year-end 2005 Swamp owed Stork $1,500 for the inventory purchased during 2005.

Separate company financial statements for Stork Corporation and Subsidiary at December 31, 2005 are summarized in the first two columns of the consolidation working papers.

REQUIRED:

Prepare eliminating journal entries

Complete the consolidated worksheet for year ended December 31, 2005.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

South-Western Federal Taxation 2020 Comprehensive

ISBN: 9780357109144

43rd Edition

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman