On January 1, 2000, Pastel Corporation acquired 70% of the outstanding shares of Summer Company for $85,000

Question:

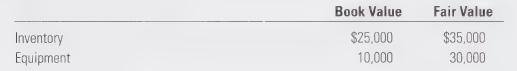

On January 1, 2000, Pastel Corporation acquired 70% of the outstanding shares of Summer Company for $85,000 cash. On that date, Summer Company had $35,000 of common shares outstanding and $25,000 of retained earnings. On January 1, 2000, the book values of each of Summer Company’s identifiable assets and liabilities were equal to their fair value except for the following:

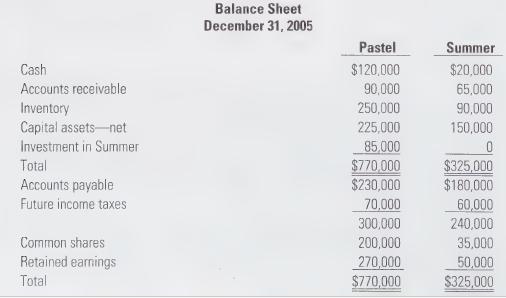

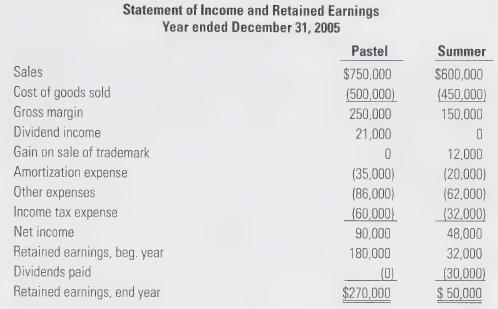

The equipment had a useful life of 10 years as at January 1, 2000, and all inventory was sold during 2000. The following are the separate entity financial statements for Pastel and Summer at December 31, 2005:

Additional Information:

1. On January 1, 2002, Pastel sold Summer a trademark with a net book value of $20,000 for cash consideration of $28,000. The trademark has an indefinite useful life. On July 1, 2005, Summer sold the trademark to an unrelated company for cash consideration of $40,000.

2. Summer sells goods to Pastel at 25% above cost. Total sales from Summer to Pastel during 2005 were $50,000, of which $20,000 remained in Pastel’s inventory at year end. Pastel still owed Summer $18,000 for this inventory at December 31, 2005. In 2004, total sales from Summer to Pastel were $40,000, of which $10,000 remained in Pastel’s inventory at year end.

3. Pastel uses the cost method to account for its investment in Summer. Both companies pay taxes at a rate of 40%, and have done so since 1999. None of the transactions detailed above are considered capital gains for tax purposes.

Ignore future taxes when calculating the purchase price discrepancy.

4. Each year, goodwill is evaluated to determine if there has been permanent impairment. To date there has been no impairment in value.

Required:

a. Prepare a calculation for the purchase price discrepancy and goodwill as at January 1, 2000.

b. Prepare a consolidated statement of income for the year ended December 31, 2005.

c. What would the balance be for each of the consolidated balance sheet accounts as at December 31, 2005?

i. accounts receivable

ii. Inventory

iii, equipment

iv. non-controlling interest

Step by Step Answer: