Paper Corporation purchased 70% of the outstanding shares of Sand Limited on January 1, 2002, at a

Question:

Paper Corporation purchased 70% of the outstanding shares of Sand Limited on January 1, 2002, at a cost of $80,000. Paper has always used the cost method to account for its investments. On January 1, 2002, Sand had common shares of $50,000 and retained earnings of $30,000, and fair values were equal to carrying value for all of its net assets except for inventory (fair value was $9,000 less than book value) and equipment (fair value was $24,000 greater than book value). The equipment had an estimated remaining life of six years on January 1, 2002.

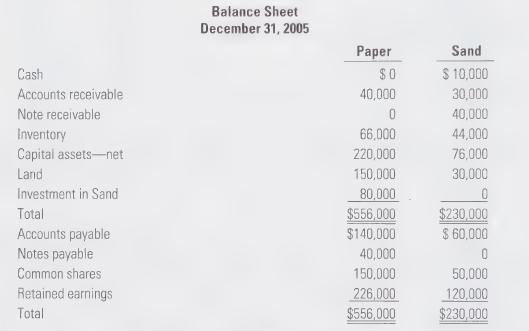

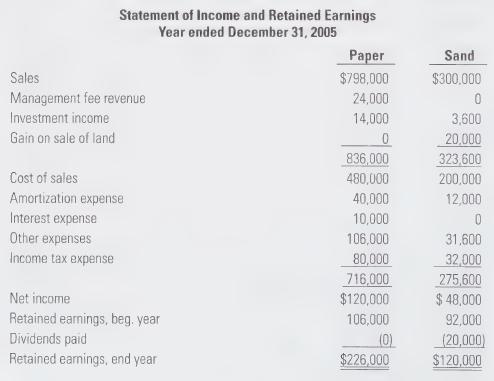

The following are the separate-entity financial statements of Paper and Sand at December 31, 2005:

Additional Information:

1. During 2005, Sand made a cash payment of $2,000 per month to Paper for management fees, which is included in Sand’s “other expenses.”

2. During 2005, Paper made intercompany sales of $100,000 to Sand. The December 31, 2005, inventory of Sand contained goods purchased from Paper amounting to $30,000. These sales had a gross profit of 35%.

3. On April 1, 2005, Paper acquired land from Sand for $40,000. This land had been recorded on Sand’s books at a net book value of $20,000. Paper paid for the land by signing a $40,000 note payable to Sand, bearing interest at 8%.

Interest for 2005 was paid by Paper in cash on December 31, 2005. This land was still being held by Paper on December 31, 2005.

4. The fair value of the consolidated goodwill remained unchanged from January 1, 2002, to July 1, 2005. On July 1, 2005, a valuation was performed, indicating that the fair value of consolidated goodwill was $3,500.

5. Sand and Paper pay taxes at a 40% rate. Assume that none of the gains or losses were capital gains or losses. Ignore the impact of future taxes for all transactions.

Required:

a. Prepare a calculation of goodwill and any unamortized purchase price discrepancy as at December 31, 2005.

b. Prepare Paper’s consolidated income statement for the year ended December 31, 2005,

c. Calculate the following balances that would appear on Paper’s consolidated balance sheet as at December 31, 2005:

i. inventory

ii. land

iii. notes payable

iv. non-controlling interest

v. common shares

Step by Step Answer: