Refer to P46. During 2008, the following events occurred: 1. Silly Inc. had sales of $800,000 to

Question:

Refer to P4—6. During 2008, the following events occurred:

1. Silly Inc. had sales of $800,000 to Practical Corp. Silly’s gross margin was still 40% of selling price, and its income tax rate continued to be 25%. At yearend,

$120,000 of these goods were still in Practical’s inventory.

2. On October 1, 2008, Silly sold its land to Practical for $185,000 (on which income taxes were due for $20,000). Practical paid Silly $85,000 and gave a promissory note for $100,000 that was due in three years at 10% interest per year, simple interest to be paid at maturity.

3. $60,000 that Silly owed to Practical at the beginning of the year was repaid during 2008.

4. Practical paid dividends of $100,000 during the year; Silly paid dividends of

$70,000.

The pre-closing trial balances of Practical and Silly at December 31, 2008, are shown below.

Required:

a. Determine Practical Corp.’s equity in the earnings of Silly Inc. for 2008. Determine the balance of the Investment in Silly account on Practical’s books at December 31, 2008, assuming that Practical recorded its investment on the equity basis.

b. Prepare a comparative consolidated balance sheet and income statement for Practical Corp. for 2008.

Data from P4—6.

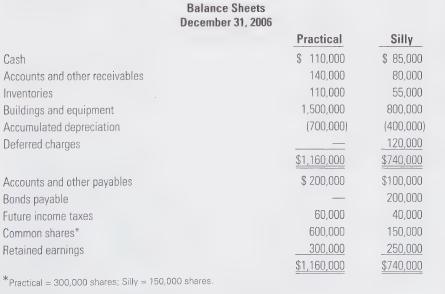

On January 4, 2007, Practical Corp. acquired 100% of the outstanding common shares of Silly Inc. by a share-for-share exchange of its own shares valued at $1,000,000. The balance sheets of both companies just prior to the share exchange are shown below. Silly had patents not shown on the balance sheet, but that had an estimated fair value of $200,000 and an estimated remaining productive life of four years. Silly’s buildings and equipment had an estimated fair value $300,000 in excess of book value, and the deferred charges were assumed to have a fair value of zero. Silly’s building and equipment are being depreciated on the straight-line basis and have a remaining useful life of 10 years. The deferred charges are being amortized over three years.

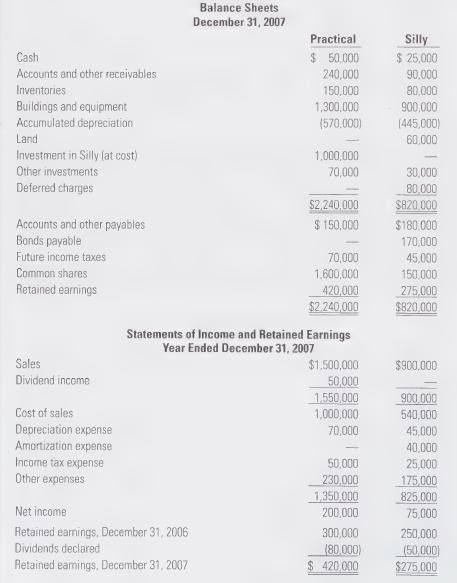

During 2007, the year following the acquisition, Silly borrowed $100,000 from Practical; $40,000 was repaid and $60,000 is still outstanding at year-end. No interest is being charged on the loan. Through the year, Silly sold goods to Practical totalling $400,000. Silly’s gross margin is 40% of selling price, and its tax rate is 25%. Three-quarters of these goods were resold by Practical to its customers for $450,000. Dividend declarations amounted to $80,000 by Practical and $50,000 by Silly. There were no other intercompany transactions. The year-end 2007 balance sheets and income statements for Practical and Silly are shown below.

Step by Step Answer: