Bristol Brights purchases and installs sky lights. The entitys estimated sales and expenses for the first 4

Question:

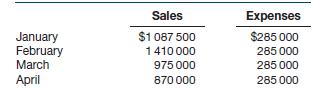

Bristol Brights purchases and installs sky lights. The entity’s estimated sales and expenses for the first 4 months of 2020 are below.

Actual sales for November and December 2019 were $825 000 and $975 000 respectively and actual expenses were $285 000 for each month.

All sales are on credit, and the firm estimates that 40% of the accounts receivable will be collected in the month after sale with the other 60% collected in the second month following sale.

The average selling price for the products sold is $5000. The cash balance as at 1 January 2020 is expected to be $100 000.

The firm pays for 30% of its purchases in the month after purchase and the balance is paid in the second month following purchase. Average gross profit margin is 50%. The firm plans to continue maintaining an end-of-month inventory equal to 20% of the next month’s projected cost of sales. Depreciation amounting to $24 000 per month and wages of $123 000 are included in the monthly expenses of $285 000. Other expenses are paid during the month they are incurred.

Required

(a) Prepare a monthly schedule of expected cash receipts for the first quarter of 2020.

(b) Prepare a monthly purchases budget for the first quarter of 2020.

(c) Prepare a monthly schedule of expected cash payments for the first quarter of 2020.

(d) Prepare a monthly cash budget for the first quarter of 2020.

(e) Prepare a monthly budgeted income statement for the first quarter of 2020.

(f) Calculate the difference between the expected increase in cash and the expected profit or loss for the first quarter. Explain why the two amounts are different.

Step by Step Answer:

Accounting

ISBN: 9780730363224

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Beattie Claire, Hellmann Andreas, Maxfield Jodie