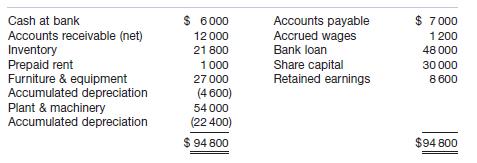

The following actual balance sheet was prepared for Colombo Clocks Ltd as at 31 March 2020. At

Question:

The following actual balance sheet was prepared for Colombo Clocks Ltd as at 31 March 2020.

At 31 March you are also provided with the following information.

1. Sales forecasts available for 2020: April $25 000; May $27 000; June $20 000.

2. Cash sales account for 50% of sales. Credit sales are collected 40% in the month of sale and 60% in the following month.

3. Purchases are expected to be made at the rate of 55% of expected sales for each month and are purchased on credit.

4. Creditors are paid 20% in the month of purchase and 80% in the next month.

5. Dividends are paid by the business at the rate of $4000 per quarter.

6. Rent on premises is $3000 per quarter, paid on the last day of the first month of each quarter.

7. Wages are normally paid as incurred and this will occur in the quarter ended 30 June. In the quarter ended 31 March, pay day fell on 25 March so 6 days wages were outstanding at 31 March and are yet to be paid. Wages are normally incurred at the rate of $5000 per month.

8. The following are paid as incurred: electricity $400 per month, interest on loan $180 per month and cleaning contractor $200 per month. The loan principal is paid at the rate of $2000 per quarter.

9. Depreciation is charged at 10% p.a. on the cost of the furniture and equipment and 15% p.a.

on the cost of the plant and machinery.

10. New machinery will be purchased for cash on 30 June 2020 for $10 000.

11. Inventory is projected to be $23 200 at 30 June 2020.

Required

(a) Prepare a budgeted income statement, a cash budget and a budgeted balance sheet for Colombo Clocks Ltd for the quarter ended 30 June 2020.

Step by Step Answer:

Accounting

ISBN: 9780730363224

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Beattie Claire, Hellmann Andreas, Maxfield Jodie