Moore Manufacturing Pty Ltd makes refrigerators and is trying to determine the cost of its ending work

Question:

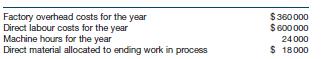

Moore Manufacturing Pty Ltd makes refrigerators and is trying to determine the cost of its ending work in process. The accountant has put together the following data for the year ended 30 June 2019.

Each refrigerator uses $300 of direct materials, $60 of direct labour and 2.4 machine hours.

Direct material is all added into the first third of the production process, direct labour is used equally throughout the entire production and machine hours are used equally throughout the first 80% of the production process. In the past, Moore Manufacturing Pty Ltd has allocated the factory overhead costs on the basis of direct labour, but the accountant and the chief executive officer (CEO) are considering whether machine hours used would better reflect the way in which factory overhead costs are incurred. The accountant needs to estimate the percentage of completion of the ending work in process and whether to use direct labour or machine hours to calculate the overhead rate. The CEO is paid a significant bonus if the profit for the year exceeds $10 000 000.

The accountant estimates that the work in process is 50% complete and that the company should continue to use direct labour to allocate factory overhead, and this will result in a profit for the year of $9 998 000.

The CEO is not happy with this and argues that the work in process is 80% complete and that machine hours should be used to allocate factory overhead.

Required

(a) Give possible reasons for the CEO preferring her method of calculating the value of ending work in process rather than using the accountant’s method.

(b) Calculate the value of ending work in process using both the accountant’s approach and the CEO’s method and the resulting change in profit to see whether your explanation in requirement

(a) is reasonable.

Step by Step Answer:

Accounting

ISBN: 9780730363224

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Beattie Claire, Hellmann Andreas, Maxfield Jodie