Racey has prepared a statement of profit or loss for the 12 month reporting period ended 30

Question:

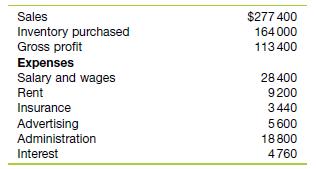

Racey has prepared a statement of profit or loss for the 12 month reporting period ended 30 June on a cash basis, showing a $43200 profit. The cash-based statement shows the following.

Additional information

• The accounts receivable and accounts payable balances at the start of the reporting period were $16400 and $9800 respectively. At the end of the reporting period, Racey had accounts receivable of $21200 and accounts payable of $19760.

• The opening inventory was $32000 and the closing inventory $38000.

• An advertising invoice of $2960 had not been paid.

• The business has equipment that cost $40400. It has a useful life of five years and an expected salvage value of $4400.

• The insurance expense represents the 12-month premium on a policy that was taken out on 30 April.

Required

a. Prepare an accrual-based statement of profit or loss for Racey for the period ended 30 June.

b. As a user of financial statements, critique why accrual accounting is preferred to cash accounting to measure financial performance.

Step by Step Answer:

Accounting Business Reporting For Decision Making

ISBN: 9780730363415

6th Edition

Authors: Jacqueline Birt, Keryn Chalmers, Suzanne Maloney, Albie Brooks, Judy Oliver