Transactions affecting Bradford Ltds accounts receivable for the year ended 30 June are presented below. On 1

Question:

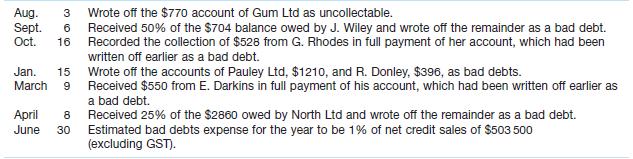

Transactions affecting Bradford Ltd’s accounts receivable for the year ended 30 June are presented below. On 1 July of the previous year, the opening balance of the Allowance for Doubtful Debts account was a credit of $1960. GST is 10%.

Required

(a) Prepare journal entries for each of the transactions in general journal format.

(b) Prepare the Allowance for Doubtful Debts account showing the balance of the account after the 30 June adjustment.

(c) Assume that, instead of basing the allowance on net credit sales, the allowance is based on an ageing of accounts receivable and that $8921 of the accounts receivable at 30 June were estimated to be uncollectable. Determine the adjustment necessary to bring the allowance account to the desired balance, and prepare the Allowance for Doubtful Debts account.

Step by Step Answer:

Accounting

ISBN: 9780730363224

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Beattie Claire, Hellmann Andreas, Maxfield Jodie