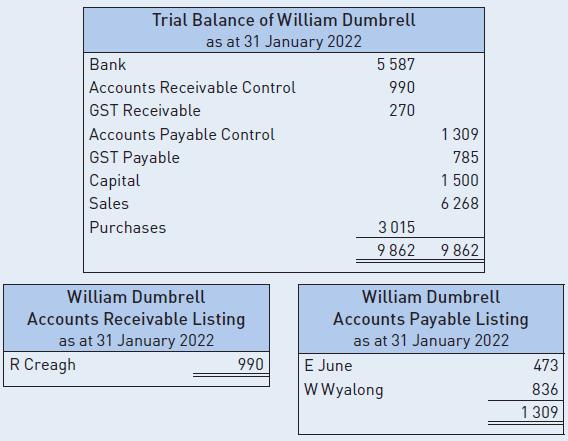

Using the information of William Dumbrell at the end of January 2022 (shown in figure 6.94) and

Question:

Using the information of William Dumbrell at the end of January 2022 (shown in figure 6.94) and the transactions for February:

• enter the appropriate journal abbreviation next to each transaction

• prepare the relevant journals for the month of February 2022

• enter the opening balances in the appropriate ledgers

• post the journals to the general ledger in T account format, and the accounts receivable and accounts payable ledgers in columnar account format

• prepare a trial balance from the general ledger, and

• prepare accounts receivable and payable listings that balance with the respective accounts in the general ledger.

__________ 1 R Creagh settled her account and took advantage of the $22 discount.

__________ 1 Purchased inventory from B Atlow $275 ($250 + $25 GST) and paid by direct deposit.

__________ 2 Remitted funds to W Wyalong for $803 in full settlement of last month’s balance.

__________ 2 Electronic transfer of $429 to E June as received $44 discount.

__________ 3 N Hodges bought goods on credit $1881 ($1710 + $171 GST).

__________ 3 Received tax invoice for advertising from Khan Berra and Co for $792 ($720 + $72 GST).

__________ 5 Sold inventory for cash to M Hextall for $2464 ($2240 + $224 GST).

__________ 7 Tax invoice arrived with stock from W Wyalong $385 ($350 + $35 GST).

__________ 8 Tax invoice mailed to R Creagh $2904 ($2640 + $264 GST) for stock.

__________ 10 Cash sale $1716 ($1560 + $156 GST).

__________ 12 I Pritchard bought stock on credit for $1661 ($1510 + $151 GST).

__________ 15 Forwarded tax invoice for $2915 ($2650 + $265 GST) to G Laming for goods.

__________ 20 Sold goods on credit to I Pritchard $1188 ($1080 + $108 GST).

__________ 22 Commission received $286 ($260 + $26 GST) from K Ninos and Co.

__________ 25 Sold stock to S Cooper, who had remitted funds direct into the bank account for $1925 ($1750 + $175 GST).

__________ 27 G Laming purchased on credit and goods were tax invoiced for $2101 ($1910 + $191 GST).

__________ 28 W Wyalong’s tax invoice received $352 ($320 + $32 GST) for goods.

__________ 28 Received funds from N Hodges who took the $44 discount allowed.

Step by Step Answer:

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson