Enter the appropriate journal abbreviation next to each transaction listed below. Use these transactions and the following

Question:

Enter the appropriate journal abbreviation next to each transaction listed below.

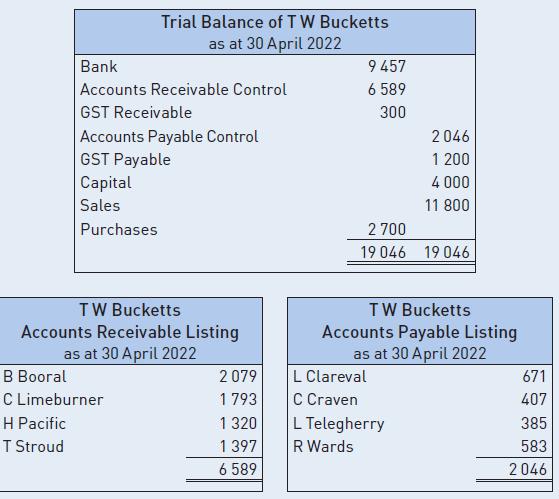

Use these transactions and the following information (shown in figure 6.95) to prepare the journals of T W Bucketts for May 2022. Post the journals to the general, accounts receivable and accounts payable ledgers using the relevant account format. Prepare a trial balance and appropriate listings for the subsidiary ledgers as at 31 May 2022.

__________ 1 Sold stock to T Stroud $1001 ($910 + $91 GST).

__________ 1 Received from C Limeburner for April account $1749 and allowed discount.

__________ 1 Funds received for April invoices $1397 from T Stroud.

__________ 1 B Booral paid April invoices less $55 discount.

__________ 1 Purchased stock from R Wards $341 ($310 + $31 GST).

__________ 1 Remitted funds to C Craven $407 for last month’s account.

__________ 1 Transferred $374 to L Telegherry in full settlement of April account.

__________ 2 H Pacific’s direct deposit of $1320 received in full settlement of April invoices.

__________ 2 Electronic transfer to L Clareval of $649 to pay April tax invoices and took discount.

__________ 2 R Wards’ April account was paid in full by electronic transfer.

__________ 7 Received tax invoice for $528 ($480 + $48 GST) from K Krambach for inventory.

__________ 10 Sold goods on credit to S Stratford for $1782 ($1620 + $162 GST).

__________ 10 B Kundibakh forwarded $3883 ($3530 + $353 GST) tax invoice for a new computer.

__________ 12 Purchased stationery for $341 ($310 + $31 GST) with a debit card.

__________ 13 Computer paper and toner (use stationery account) $671 ($610 + $61 GST) received from Burrell Stationery.

__________ 15 T W Bucketts sold inventory on credit $1441 ($1310 + $131 GST) to Dale Forbes.

__________ 15 Sold goods to C Limeburner $2332 ($2120 + $212 GST).

__________ 15 Purchased goods on credit from R Wards $693 ($630 + $63 GST).

__________ 16 Sent tax invoice $1969 ($1790 + $179 GST) to G Gloucester for stock delivered.

__________ 16 Inventory purchased $594 ($540 + $54 GST) from C Craven.

__________ 17 Sold goods for cash to L Mograni for $1177 ($1070 + $107 GST).

__________ 18 B Booral purchased $3003 ($2730 + $273 GST) of stock.

__________ 19 Adjustment credit note received from C Craven $66 ($60 + $6 GST) for damaged inventory.

__________ 19 Tax invoice received from L Telegherry $1716 ($1560 + $156 GST) for goods.

__________ 20 Mailed adjustment credit note for $154 ($140 + $14 GST) to B Booral for overcharge.

__________ 20 Bought goods from L Clareval $1507 ($1370 + $137 GST).

__________ 20 Used debit card to pay T Tinonee $253 ($230 + $23 GST) for stationery.

__________ 21 Cash sales $1760 ($1600 + $160 GST).

__________ 21 T Stroud was sold goods on credit for $1837 ($1670 + $167 GST).

__________ 21 Purchased inventory on credit from K Krambach $924 ($840 + $84 GST).

__________ 25 G Angat purchased goods $1122 ($1020 + $102 GST) and remitted funds direct into bank.

__________ 25 Tax invoice received for $858 ($780 + $78 GST) from C Craven for inventory.

__________ 25 Tax invoice for 12 months’ insurance for $1012 ($920 + $92 GST) from R Kimbriki.

__________ 26 T W Bucketts returned goods to C Craven $88 ($80 + $8 GST).

__________ 28 Forwarded adjustment credit note to T Stroud for damaged goods $77 ($70 + $7 GST).

__________ 28 Tax invoice $3542 ($3220 + $322 GST) mailed to H Pacific for inventory.

__________ 29 Paid Purfleet Garage $737 ($670 + $67 GST) for this month’s petrol.

__________ 31 Received funds from S Stratford in full settlement of account less $44 discount.

Step by Step Answer:

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson