Saeed does not keep proper books of account for his business but he has provided the following

Question:

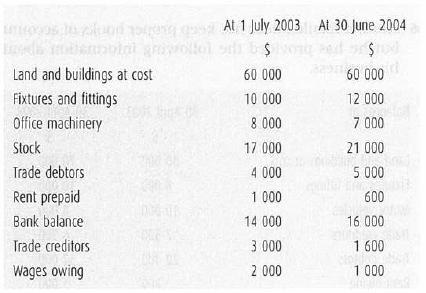

Saeed does not keep proper books of account for his business but he has provided the following details of his assets and liabilities.

Further information

1. Land and buildings have been revalued at $90 000 at 30 June 2004.

2. Office machinery at 30 June 2004 included a computer costing $1400, which Saeed had paid for from his personal bank account.

3. Saeed had withdrawn $200 per week from the business in cash, and a total of $2000 of goods for his own use during the year to 30 June 2004.

Required

Calculate Saeed's profit or loss for the year ended 30 June 2004.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: