Wilhelmina is a trader whose financial year ends on 31 March. Her trial balance at 31 March

Question:

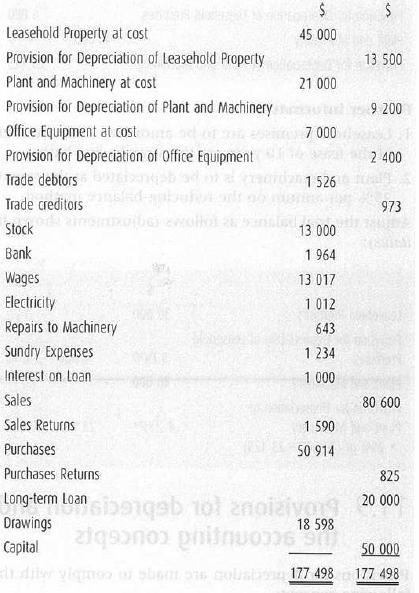

Wilhelmina is a trader whose financial year ends on 31 March. Her trial balance at 31 March 2004 was as follows.

Further information

1. Stock at 31 March 2004 cost $16.000.

2. The loan was received in 2001 and is repayable in 2006. Interest on the loan is at the rate of 10% per annum.

3. Plant and machinery includes $6000 for a machine bought on hire purchase on 1 January 2004. The cash price of the machine is $30 000. The balance is payable in four quarterly instalments of $6200, including interest, on 1 April 2004, 1 July 2004, 1 October 2004 and 1 January 2005.

4. The leasehold property was acquired on 1 October 1998 for a period of 15 years. It is being amortised on the straight-line basis.

5. Plant and machinery are depreciated on the reducing- balance method using the annual rate of 25%.

6. Office equipment is depreciated at 15% per annum on the straight-line basis. 7. At 31 March 2004, $300 was owing for electricity, and sundry expenses of $180 had been prepaid.

Required

(a) Prepare Wilhelmina's Trading and Profit and Loss Account for the year ended 31 March 2004.

(b) Prepare the Balance Sheet at 31 March 2004.

Step by Step Answer: