The following balances have been extracted from Joel's books at 31 December 2003. Machinery at Cost $18

Question:

The following balances have been extracted from Joel's books at 31 December 2003. Machinery at Cost $18 000; Provision for Depreciation of Machinery $9600.

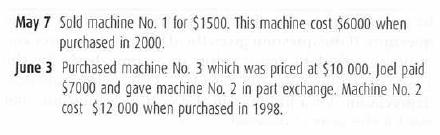

Joel's transactions in 2004 included the following.

Joel depreciates his machinery using the straight-line method and the rate of 10% per annum. He provides for a full year's depreciation in the year of purchase, but none in the year of disposal.

Required

Prepare the following accounts to show the transactions on 7 May and 3 June:

(a) Machinery at Cost

(b) Provision for Depreciation of Machinery

(c) Machinery Disposal.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: