This question requires you to correct some figures on a set of company financial statements. It should

Question:

This question requires you to correct some figures on a set of company financial statements. It should prove useful practice for the material that you covered in Chapters2 and 3, as well as helping you to become more familiar with the financial statements of a company.

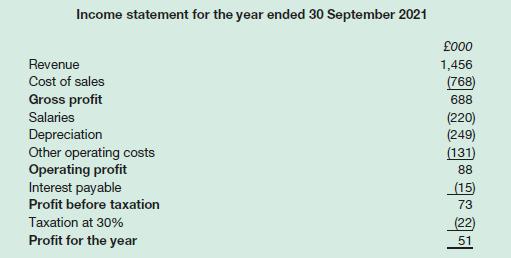

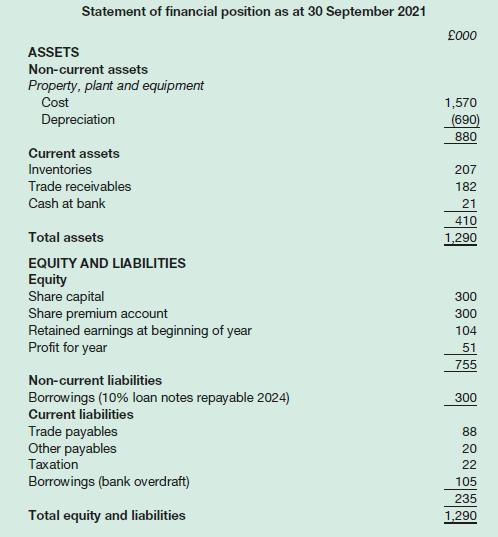

Presented below is a draft set of simplified financial statements for Pear Limited for the year ended 30 September 2021.

The following information is available:

1. Depreciation has not been charged on office equipment with a carrying amount of £100,000. This class of assets is depreciated at 12 per cent a year using the reducing-balance method.

2. A new machine was purchased, on credit, for £30,000 and delivered on 29 September 2021 but has not been included in the financial statements. (Ignore depreciation.)

3. A sales invoice to the value of £18,000 for September 2021 has been omitted from the financial statements.

(The cost of sales figure is stated correctly.)

4. A dividend of £25,000 had been approved by the shareholders before 30 September 2021 but was unpaid at that date. This is not reflected in the financial statements.

5. The interest payable on the loan notes for the second half-year was not paid until 1October 2021 and has not been included in the financial statements.

6. Irrecoverable debts are to be written off representing 2 per cent of trade receivables outstanding at the year-end.

7. An invoice for electricity to the value of £2,000 for the quarter ended 30 September 2021 arrived on 4 October and has not been included in the financial statements.

8. The charge for taxation will have to be amended to take account of the above information. Make the simplifying assumption that tax is payable shortly after the end of the year, at the rate of 30 per cent of the profit before tax.

Required:

Prepare a revised set of financial statements for the year ended 30 September 2021 incorporating the additional information in 1 to 8 above. (Work to the nearest £1,000.)

Step by Step Answer:

Accounting And Finance For Non Specialists

ISBN: 9781292334691

12th Edition

Authors: Peter Atrill, Eddie McLaney