Beatrice has prepared a statement of profit or loss for the 12-month reporting period ended 30 June

Question:

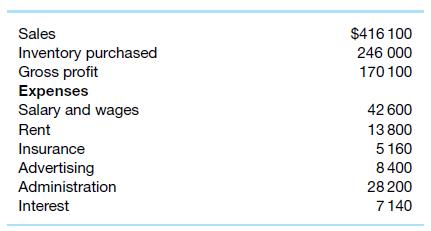

Beatrice has prepared a statement of profit or loss for the 12-month reporting period ended 30 June on a cash basis, showing a $64800 profit. The cash-based statement shows the following.

Additional information

• The accounts receivable and accounts payable balances at the start of the reporting period were $24600 and $14700 respectively. At the end of the reporting period, Beatrice had accounts receivable of $31800 and accounts payable of $29640.

• The opening inventory was $48000 and the closing inventory was $57000.

• An advertising invoice of $4440 had not been paid.

• The business has equipment that cost $60600. This has a useful life of five years and an expected salvage value of $6600.

• The insurance expense represents the 12-month premium on a policy that was taken out on 30 April.

Required

(a) Prepare an accrual-based statement of profit or loss for Beatrice for the period ended 30 June.

(b) As a user of financial statements, critique why accrual accounting is preferred to cash accounting to measure financial performance.

Step by Step Answer:

Accounting Business Reporting For Decision Making

ISBN: 9780730369325

7th Edition

Authors: Jacqueline Birt, Keryn Chalmers, Suzanne Maloney, Albie Brooks, Judy Oliver, David Bond