Accounting with several journals Icasas & Daughters uses sales, purchases, cash receipts, cash payments and a general

Question:

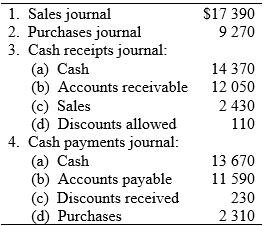

Accounting with several journals Icasas & Daughters uses sales, purchases, cash receipts, cash payments and a general journal (ignore GST). The following column totals were taken from the entity’s journals at the end of December.

The balance in the Accounts Receivable Control account on 1 December was $6 950 and the Accounts Payable Control account balance was $9 850.

Required

(a) At the end of December, the total amount from the sales journal should be posted to what account or accounts?

(b) At the end of December, the total amount from the purchases journal should be posted to what account or accounts?

(c) For each column total in the cash receipts and the cash payments journals, specify whether it would be posted to the general ledger as a debit or a credit, and to which account.

(d) After the amounts in the journals have been posted to the general ledger for December, what would be the balances in the Accounts Receivable Control and the Accounts Payable Control accounts?

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie