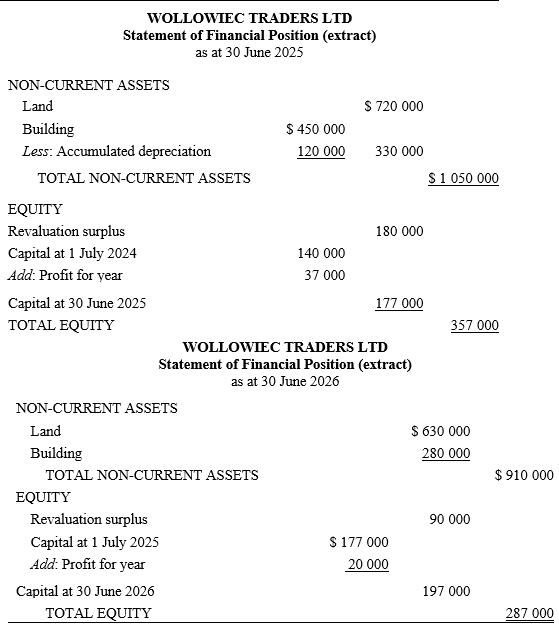

Below are extracts from the financial reports of Wollowiec Traders Ltd for the years ended 30 June

Question:

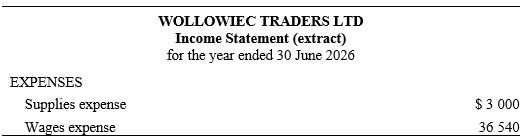

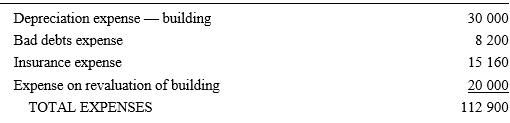

Below are extracts from the financial reports of Wollowiec Traders Ltd for the years ended 30 June 2025 and 30 June 2026.

Additional information 1. The revaluation surplus at 30 June 2025 was raised entirely as the result of a previous revaluation increase in relation to the land.

2. No land or buildings were acquired or disposed of during the year ended 30 June 2026.

3. A revaluation of the land and buildings was carried out on 30 June 2026 after all adjusting entries had been entered and posted. The revaluation adjustment was entered into the accounts on 30 June 2026, and the statement of financial position at that date reflects the fair values in accordance with the revaluation.

4. After the revaluation, the building was reassessed to have a residual value of \($38\) 000 and a remaining useful life of 15 years. The building is to be depreciated using the straight-line method of depreciation.

5. The land and buildings were sold on 31 December 2026. A lump sum of \($850\) 000 was received. The proceeds were allocated to the land and buildings at \($600\) 000 and \($250\) 000 respectively. Ignore GST.

Required

(a) Calculate the balance of the Accumulated Depreciation – Building account immediately before the revaluation on 30 June 2026.

(b) Prepare the general journal entries to record:

i. the revaluation of the building on 30 June 2026 ii. the revaluation of the land on 30 June 2026 iii. the disposal of the land on 31 December 2026 iv. the disposal of the building on 31 December 2026.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie