Outback Get Away Ltd sells four-wheel drive accessories and recovery equipment on credit. The accounting records at

Question:

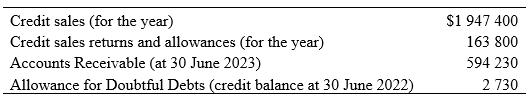

Outback Get Away Ltd sells four-wheel drive accessories and recovery equipment on credit. The accounting records at 30 June 2023 highlights the following. Ignore GST.

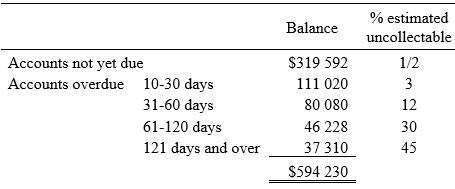

In the past, the company’s yearly bad debts expense had been estimated at 2.5% of net credit sales revenue. Management requested the accountant prepare a comparison between the net credit sales method and an aged analysis of receivables to determine which method may be more appropriate for use in accounting for bad and doubtful debts. A historical analysis was performed and identified the following percentages to calculate potential bad debts:

Required:

(a) Prepare the journal entries to adjust the Allowance for Doubtful Debts at 30 June 2023 under:

i. the net credit sales method ii. the ageing of accounts receivable method.

(b) Determine the balance in the Allowance for Doubtful Debts account under both methods.

(c) Assume that the allowance account had a debit balance of $1495 at 30 June 2022. Show the journal entries to record the allowance for doubtful debts at 30 June 2023 under:

i. the net credit sales method ii. the ageing of accounts receivable method.

(d) Using the journal entries from requirement C, determine the balance in the allowance account under both methods.

(e) Explain, with reference to requirements B and D, why the two different methods result in different balances.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie