Great Outdoors Ltd sells outdoor furniture settings on credit. The accounting records at 30 June 2019 reveal

Question:

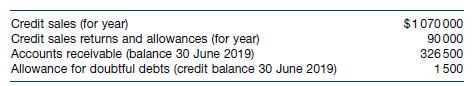

Great Outdoors Ltd sells outdoor furniture settings on credit. The accounting records at 30 June 2019 reveal the following. Ignore GST.

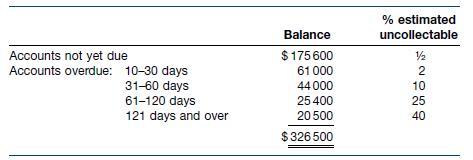

In the past, the company’s yearly bad debts expense had been estimated at 2% of net credit sales revenue. It was decided to compare the current method with an ageing of the accounts receivable method. The following analysis was obtained with respect to the accounts receivable.

Required

(a) Prepare the journal entries to adjust the Allowance for Doubtful Debts at 30 June 2019 under:

i. the net credit sales method

ii. the ageing of accounts receivable method.

(b) Determine the balance in the Allowance for Doubtful Debts account under both methods.

(c) Assume that the allowance account had a debit balance of $850 at 30 June 2019. Show the journal entries to record the allowance for doubtful debts at 30 June 2019 under:

i. the net credit sales method

ii. the ageing of accounts receivable method.

(d) Using the journal entries from requirement (c), determine the balance in the allowance account under both methods.

(e) Explain, with reference to requirements (b) and (d), why the two different methods result in different balances.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield