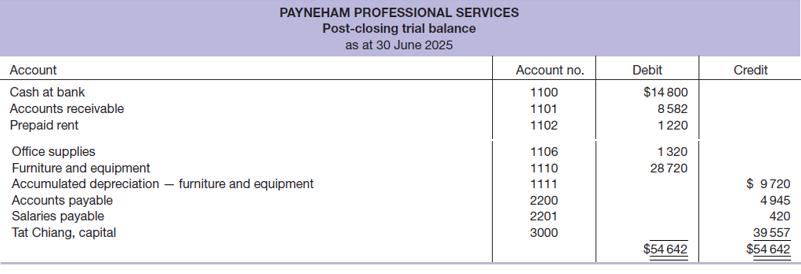

The post-closing trial balance at 30 June 2025 of Payneham Professional Services is shown below. Transactions completed

Question:

The post-closing trial balance at 30 June 2025 of Payneham Professional Services is shown below.

Transactions completed during the year ended 30 June 2026 are summarised below.

1. Collections on accounts receivable totalled \($82\) 060.

2. Consulting fees of \($88\) 150 were receivable during the year. Clients are invoiced after services are provided and are given 30 days in which to pay.

3. Rent paid in advance was \($14\) 580.

4. Office supplies were purchased during the year for \($380\) in cash and \($420\) plus GST on credit.

5. Tat withdrew \($25\) 000 for private use.

6. Salary payments amounted to \($31\) 940, of which \($420\) was for salaries accrued to the end of the year ending 30 June 2026.

7. Advertising totalling \($3360\) was purchased on credit.

8. Electricity expense of \($3600\) was paid.

9. Accounts payable of \($2880\) were paid.

The following additional information should be considered for adjusting entries.

10. Unused office supplies on hand at the end of the year totalled \($760.

11.\) Depreciation on the furniture and equipment is \($4600.

12.\) Salaries earned but not paid amount to \($1180.

13.\) Rent paid in advance in transaction 3. Rent for 6 months of \($7290\) plus GST was paid in advance on 1 August and 1 February.

Required

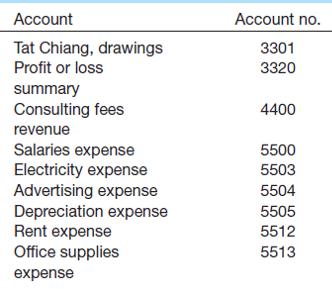

(a) Prepare the ledger of Payneham Professional Services by opening T accounts for the accounts listed in the post-closing trial balance and for the accounts listed below. Post the 30 June 2025 balances.

(b) Prepare journal entries to record the transactions completed (numbers 1–9).

(c) Post the entries to the T accounts.

(d) Journalise and post the adjusting entries.

(e) Prepare a 10-column worksheet for the year ended 30 June 2026.

(f) Prepare an income statement, a statement of changes in equity and a balance sheet.

(g) Journalise and post the closing entries.

(h) Prepare a post-closing trial balance.

(i) Prepare any suitable reversing entries on 1 July 2026.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie