The unadjusted trial balance of Tenterfield Tree Specialist, which keeps trees healthy or remove them if they

Question:

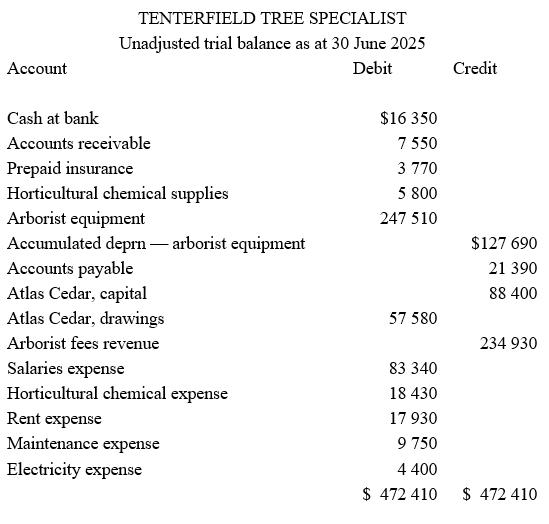

The unadjusted trial balance of Tenterfield Tree Specialist, which keeps trees healthy or remove them if they cannot be saved, appears as shown below. Ignore GST.

Additional information 1. Expired insurance amounts to $2360.

2. June electricity costs of $1040 have not been paid or recorded. No tax invoice has been received.

3. A stock take of the horticultural chemical supplies at 30 June 2025 found the stock on hand cost $3250.

4. Depreciation on the gardening equipment is $51 110.

5. Arborist fees of $4150 were received in advance and were not considered to be revenue at balance date.

6. The Rent expense account contains $4530 paid for July 2025 rent.

7. A tree repair fee of $1200 received in cash was recorded by debiting Accounts receivable.

8. Salaries earned amounting to $1670 will be paid in July and have not been recorded.

Required

(a) Set up T accounts for the accounts listed in the trial balance.

i. Enter the account balances from the trial balance to the T accounts.

ii. Post the adjusting information directly to the T accounts.

(b) Prepare an adjusted trial balance.

(c) Prepare an income statement and a statement of changes in equity for the year ended 30 June 2025.

(d) Prepare a balance sheet as at 30 June 2025.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie