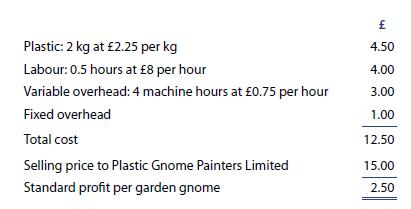

Vijay Manufacturing produces garden gnomes. The standard cost card for garden gnomes is as follows: Fixed overheads

Question:

Vijay Manufacturing produces garden gnomes. The standard cost card for garden gnomes is as follows:

Fixed overheads total £24,000 and are allocated to production on the basis that 24,000 gnomes will be produced each year, 2,000 each month.

Vijay is reviewing the actual production and sales for the month of June. The weather has been wet and garden gnome sales have fallen from their normal levels. Consequently, the company has had to reduce the selling price in June to £14 per gnome in order to keep production and sales moving. Production and sales for the month were 1,800 gnomes. The input price per kg of plastic was £2.50 as a result of a sharp rise in the oil price but, because of reduced wastage and careful material handling, only 3,500 kg of plastic were used in June. Owing to the high level of unemployment in the area, Vijay has been able to pay his employees at the rate of £7.50 per hour. Total labour hours for the month were 950. Total machine hours for the month were 7,000 and the fixed and variable overheads totalled £1,600 and £5,500 respectively. Vijay has been trying to understand why his profit has fallen from its expected level for the month and has asked for your help. You are meeting him later on today to discuss his figures and to show him how his expected profit has fallen to the actual profit for the month.

Required

Draft figures for your meeting later on today with Vijay. Your figures should include:

(a) Calculations to show the profit Vijay expected to make from the production and sale of 2,000 garden gnomes in the month of June.

(b) Calculations to show the profit Vijay might have expected to make from the production and sale of 1,800 garden gnomes for the month of June.

(c) Calculations to show the profit Vijay actually did make for the month of June.

(d) A reconciliation statement showing all the necessary favourable and unfavourable variances to explain the difference between the expected profit for June calculated in (a) and the actual profit calculated in (c).

Step by Step Answer: