Zippo Drinks Limited is considering an investment in its computerized supply chain with a view to generating

Question:

Zippo Drinks Limited is considering an investment in its computerized supply chain with a view to generating cash savings from using the benefits of currently available technology. Two options are under consideration. Option 1 will cost £200,000 and operate for five years, while Option 2 will cost £245,000 and remain operational for seven years. Given the longer implementation period, Option 2 will not realize any cash savings until the end of year 2. Neither investment will have any resale value at the end of its life. Because of the scarcity of investment capital, Zippo Drinks Limited can only undertake one of the supply chain projects. The directors of the company are asking for your help in evaluating the two proposals.

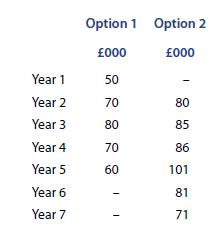

The cash savings from any new investment in the years of operation are expected to be as follows:

Zippo Drinks Limited has a cost of capital of 15%.

For your IRR calculations, you should discount the two projects using a 19% discount rate.

Required

Calculate the payback periods, ARRs, NPVs and IRRs of the two supply chain investment proposals. On the basis of your calculations, advise the directors which of the two investments they should undertake. You should also advise them of any additional considerations they should take into account when deciding which project to adopt.

Step by Step Answer: